Klarna IPO - how should it be valued compared to Affirm?

Klarna is the next big fintech IPO and recently filed its F-1. Comparing Klarna's numbers to Affirm to determine a potential valuation. Affirm is similar, not the same but still serves as a guide.

Company Overview

Klarna is a Swedish fintech company founded in 2005 that pioneered the Buy Now, Pay Later (BNPL) space in Europe before expanding globally. The company's mission is to make shopping "smoooth" by offering flexible payment solutions that benefit both consumers and merchants.

Klarna was founded by three Stockholm School of Economics students: Sebastian Siemiatkowski (CEO), Niklas Adalberth, and Victor Jacobsson. Interestingly, when they pitched their BNPL idea at a startup competition in Stockholm, the judges rejected it. However, they managed to secure initial investment from Jane Walerud, who not only invested but also connected them with a team of programmers to build the initial product.

Product

Klarna's main products focus on flexible payment options for e-commerce:

Pay in 30 days: Customers can try before they buy and only pay for what they keep.

Pay in 3 or 4: Split payments into 3 or 4 interest-free installments.

Financing: Longer-term financing options for larger purchases.

One-click payments: Simplified checkout experience.

Shopping app: A comprehensive shopping experience with features like price drop notifications, collections, and delivery tracking.

Klarna integrates with merchants through APIs and provides a seamless checkout experience both online and in-store. Unlike traditional credit products, many of Klarna's payment options are interest-free for consumers, with the company earning revenue primarily from merchants.

Business Model

Klarna has several revenue streams:

Merchant fees: Similar to Affirm, Klarna charges merchants a percentage of each transaction (estimated 3-5% on average, higher than standard credit card processing fees). This is the primary revenue source.

Consumer interest and fees: For longer financing options, Klarna charges interest. In markets where permitted, they also charge late fees (though they've reduced these in recent years).

Banking services: In some markets, Klarna operates as a licensed bank and offers savings accounts and other financial services.

In 2024, Klarna reported revenue of ~$2.8 billion USD, representing a 21% increase from the previous year. The company's GMV (Gross Merchandise Volume) reached $92 billion in 2023, a 17% year-over-year growth.

Funding History and Valuation Trajectory

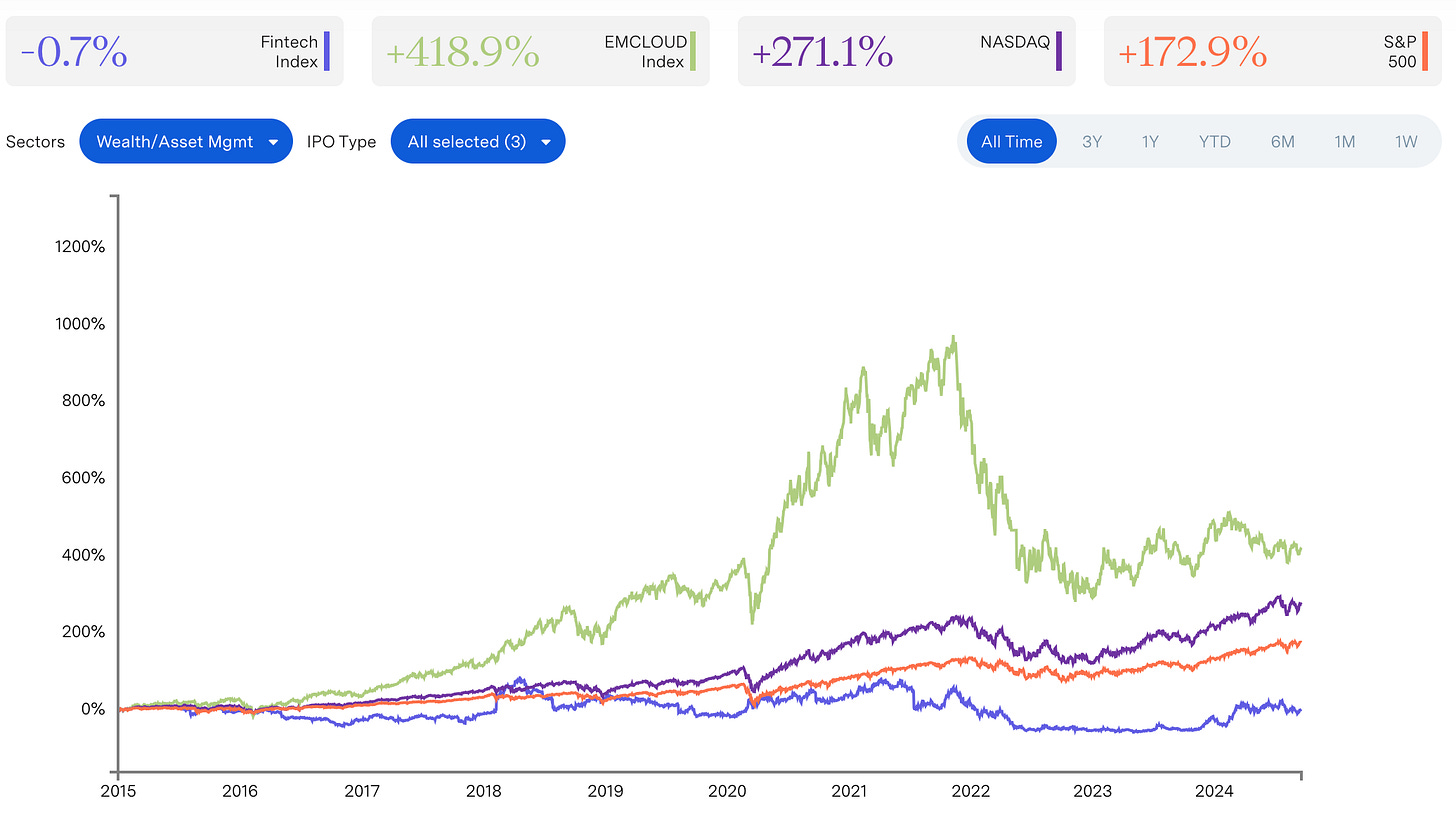

Klarna's valuation history has been volatile (given it's a 20-year-old company, and fintech has been volatile). COVID was particularly volatile for fintech companies that prioritized growth over profitability during the cheap-money era:

2007: Received first major investment from Investment AB Öresund, valuation around $60 million

2011: Sequoia Capital leads a funding round, valuation approximately $100 million

2015: Valuation reaches $2.25 billion following investment from Visa and others

2019: Valuation grows to $5.5 billion with backing from Dragoneer, Commonwealth Bank of Australia

2020: Valuation jumps to $10.65 billion (Silver Lake led round)

2021 (June): Peak valuation of $45.6 billion after SoftBank-led funding round of $639 million

2022 (July): Dramatic 85% devaluation to $6.7 billion in a down round ($800M raised)

2023: Valuation rebounds slightly to around $7.8 billion

2024: Current implied valuation is approximately $14.6 billion based on Chrysalis Investments' stake value

This valuation history mirrors the broader fintech funding environment: explosive growth during the 2020-2021 cheap money era, followed by a dramatic correction as interest rates rose and investors demanded profitability.

Major Investors

Klarna has attracted an impressive roster of investors throughout its journey:

Sequoia Capital: Early investor that has participated in multiple rounds

Visa: Strategic investment showing payment network interest in BNPL

Atomico: Niklas Zennström's VC firm has been a longtime backer

Silver Lake: Led 2020 funding round

SoftBank Vision Fund: Led the 2021 round that valued Klarna at $45.6 billion

Commonwealth Bank of Australia: Strategic investor

Chrysalis Investments: Notable investor whose recent valuation mark-up has signaled confidence

Mubadala Investment Company: Abu Dhabi sovereign wealth fund

Dragoneer Investment Group: Participated in multiple rounds

Financials

Revenue

Klarna has demonstrated consistent revenue growth over recent quarters, with particularly strong performance in early 2024:

The company has maintained 20%+ year-over-year growth throughout 2023 and 2024, with Q1 2024 showing the strongest performance at 29% YoY growth. This consistent growth trajectory is impressive given the challenging macroeconomic environment and increased competition in the BNPL space.

Klarna has pursued growth across a few areas:

European expansion: Starting in Sweden, Klarna expanded across Europe, establishing itself as the dominant BNPL provider in the region.

US market entry: In 2015, Klarna entered the US market, facing fierce competition from Affirm, Afterpay (later acquired by Block), and eventually mainstream financial players like PayPal and Apple.

Merchant acquisition: Klarna has aggressively pursued integration with major retailers. They now work with over 675,000 merchants globally, including giants like H&M, IKEA, Samsung, and Nike.

App-centric strategy: In recent years, Klarna has shifted toward becoming a consumer shopping destination, not just a payment method at checkout. Their app has evolved into a comprehensive shopping platform.

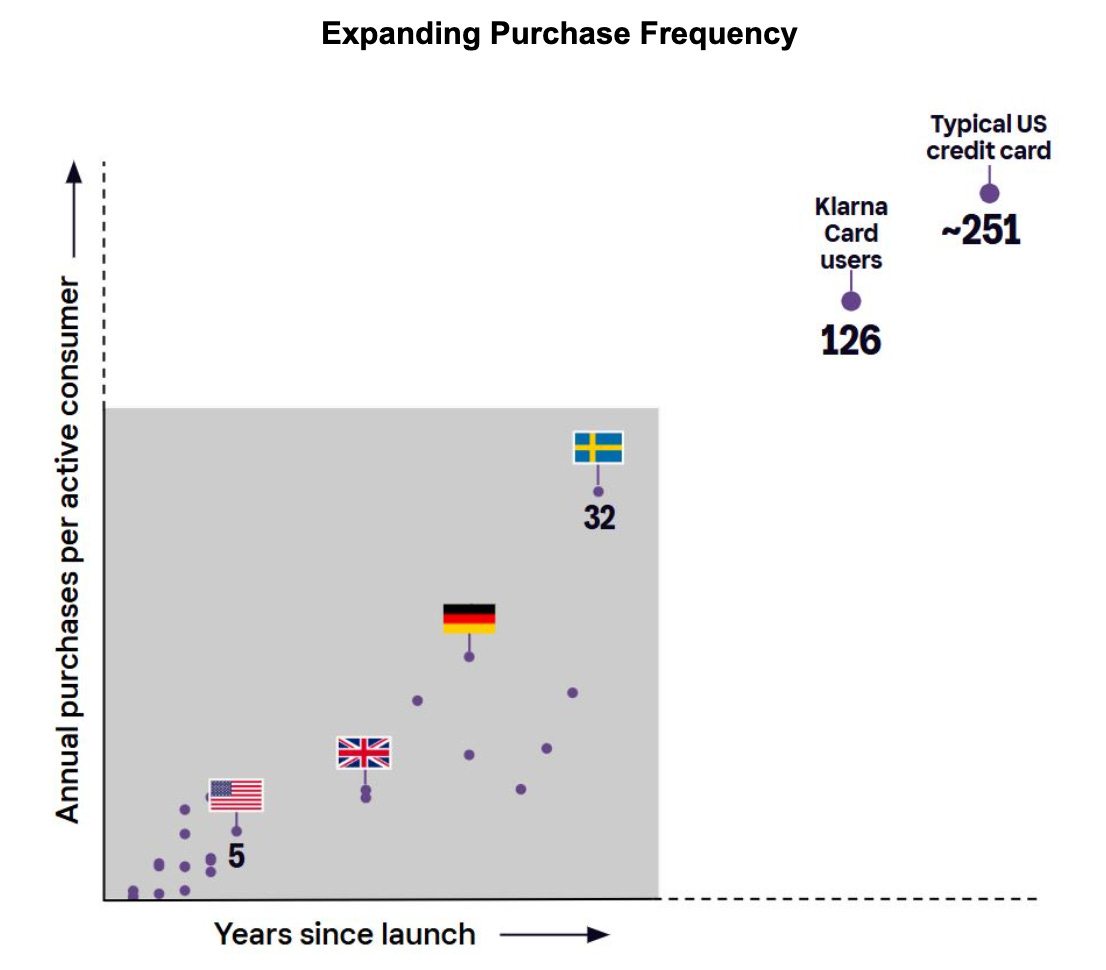

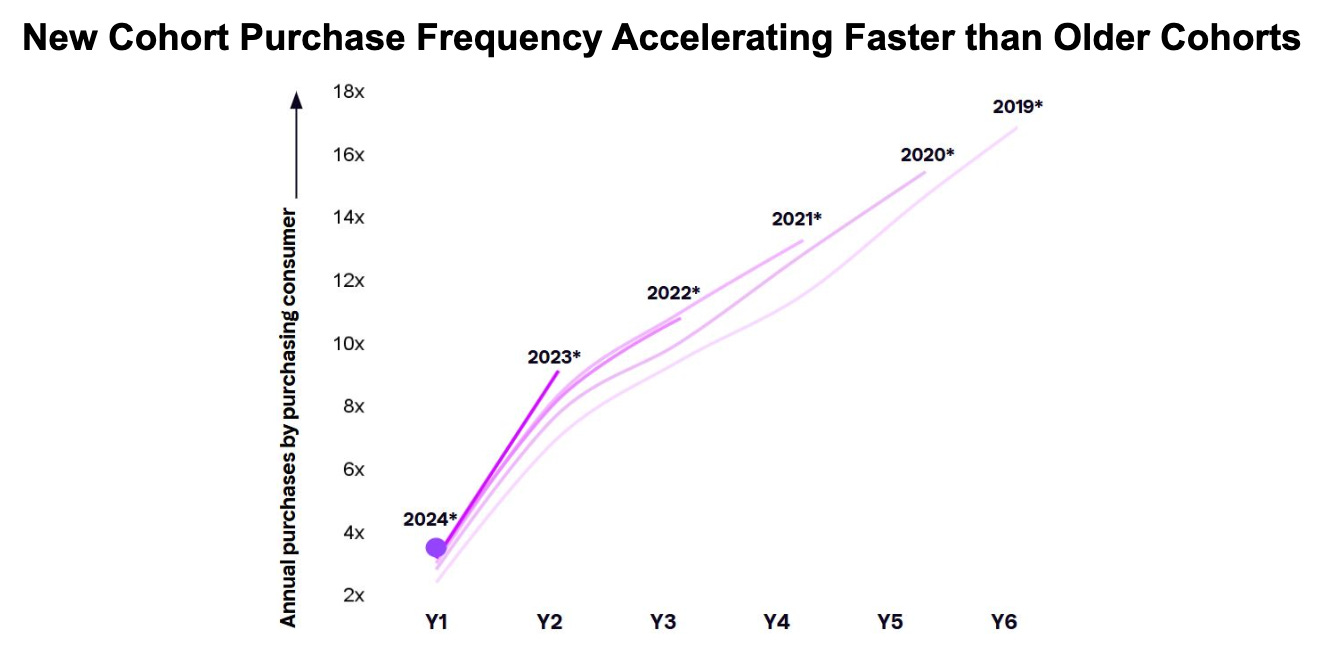

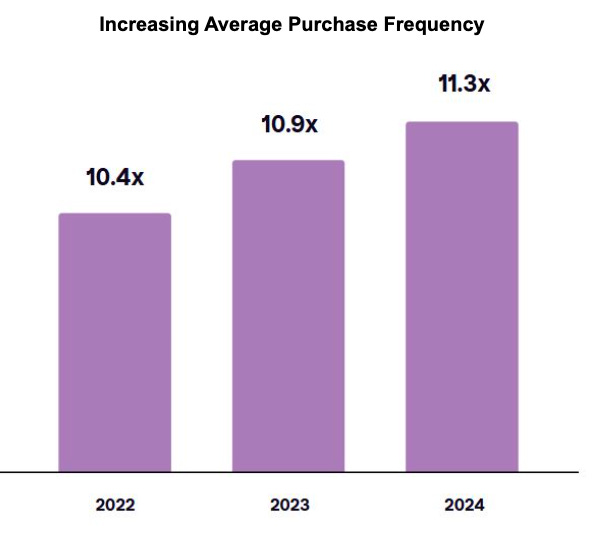

The strategy has paid off: Klarna now processes 2.5 million transactions daily (based on the 2023 report) and has 93 million active consumers worldwide. Their customer retention metrics are impressive, with early cohort data showing purchase frequency increasing from 10x in year 2 to 20x by year 7.

Noteworthy - repeat usage

Klarna is telling a story of a growing number of users and higher usage amongst customers.

According to the SEC filing, Klarna reports the following about their user transaction frequency:

Year 1 (First Year) Usage: "On average, our 2019, 2020 and 2021 consumer cohorts made three transactions during their first year on our network"

Year 2 Usage: While the document doesn't explicitly state the exact number for year 2, it mentions that users reach "at least ten transactions by year three," suggesting a progression from 3 transactions in year 1 to approximately 6-7 transactions in year 2 (based on the growth trajectory to reach 10+ by year 3)

Year 3 Usage: "at least ten transactions by year three"

The frequency of usage is significantly higher in mature markets:

Mature Markets: "In Sweden, for example, our average purchase frequency has reached 32 times per year in 2024"

US Market: "In the United States, purchase frequency in 2024 was more than five times per year and grew 17% year over year"

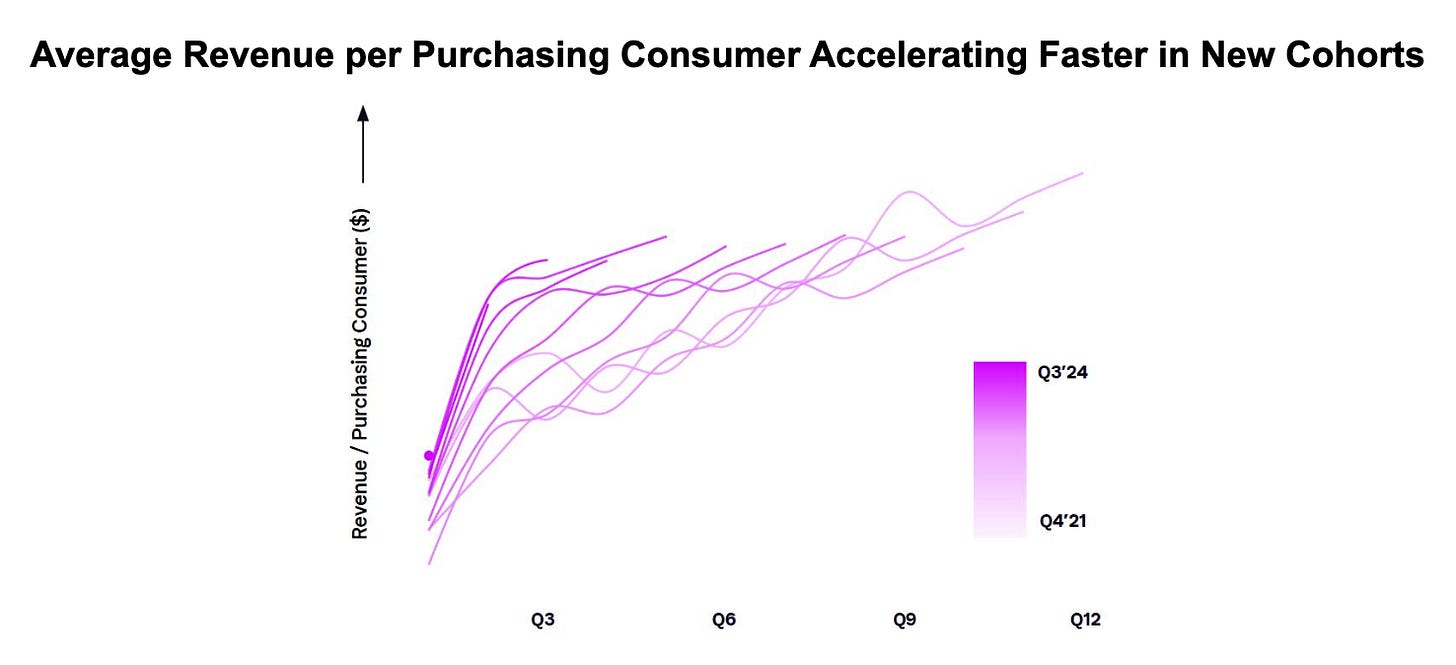

Klarna is also accelerating Average Revenue Per User and Purchase Frequency in newer cohorts.

Klarna grew active users from 79M in 2022 to 93M in 2024 (17.7% growth).

Revenue Mix

Klarna divides its revenue between Transaction and Services Revenue and Interest Revenue.

Transaction Revenue = Merchant + Advertising + Customer Service

Interest Revenue = Interest Earned

Transaction revenue has marginally decreased over the last 3 years from 78% in 2022 to 75% in 2024.

This could be primarily due to US expansion and consumers choosing a longer-time financing product, which leads to higher interest income.

The same is true for Consumer Service Revenue, which has increased from 12% to 16% in the last three years. This implies that Klarna is charging more fees to consumers. The biggest fee is “Reminder Fees,” which represented 94% in 2022, 74% in 2023, and 83% in 2024.

US Market Expansion

One of the most significant stories in Klarna's recent performance is its accelerating growth in the US market:

The growth metrics are striking:

US Revenue: 38% YoY growth in H1 2024

US Gross Profit: 93% YoY growth in H1 2024

US GMV: 50% YoY growth in Q3 2023

The substantially higher gross profit growth compared to revenue growth suggests that Klarna is not only expanding in the US but doing so with improving economics. This is crucial for the company's long-term position as the US represents both the largest potential market and the most competitive landscape for BNPL services.

Merchant Growth

Klarna shares the same story about merchant growth. Merchants have grown substantially over the last five years, and revenue per merchant is also growing.

The average revenue per merchant still grew by 6% for the ones onboarded in 2018. Recent cohorts show higher growth.

It’s not clear if Klarna is considering all onboarded merchants or only the active ones. I’m assuming that it’s all merchants in that cohort.

Portfolio Performance

Klarna has rapidly reduced its overall credit losses (as a percentage of GMV) over the past six years.

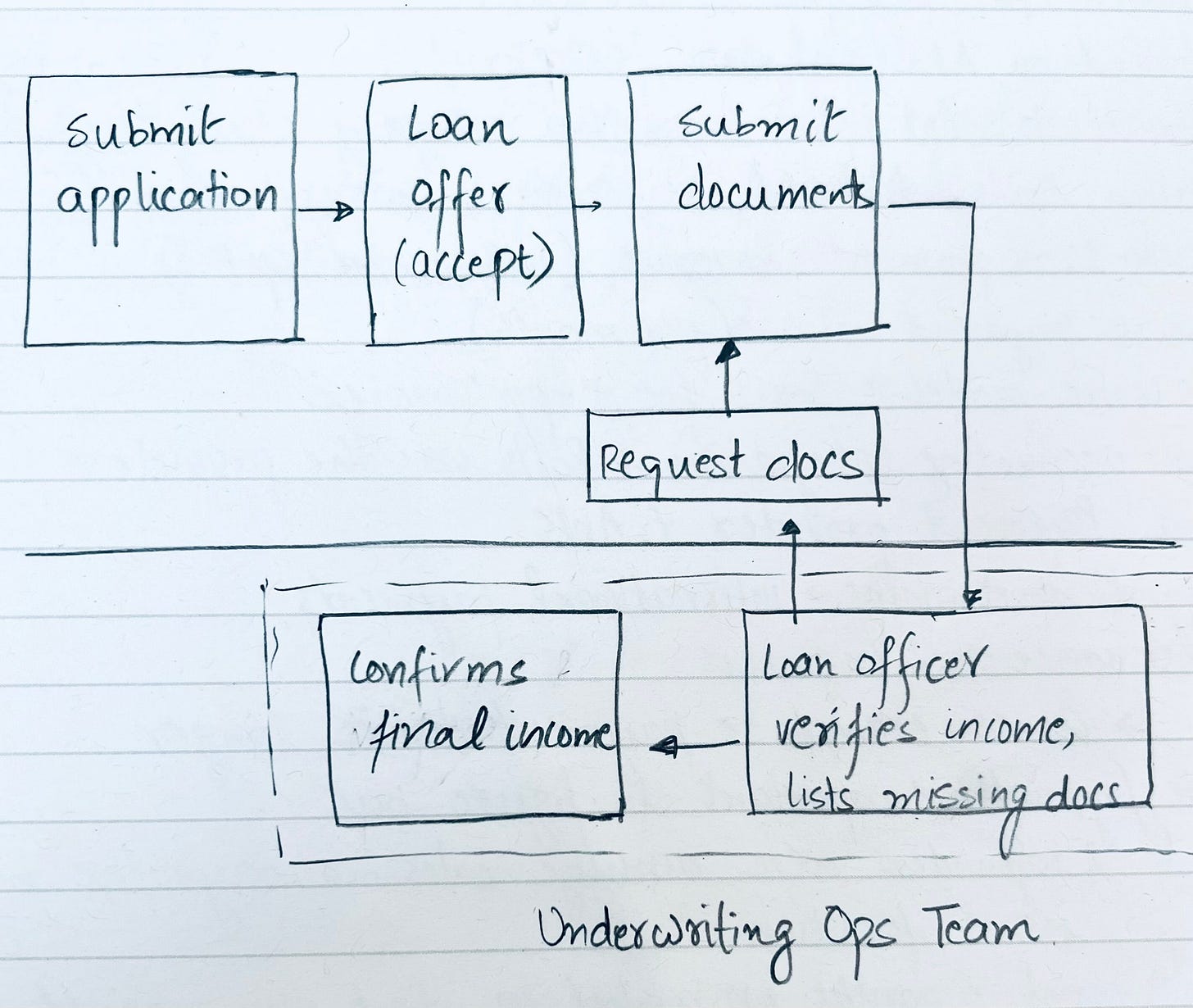

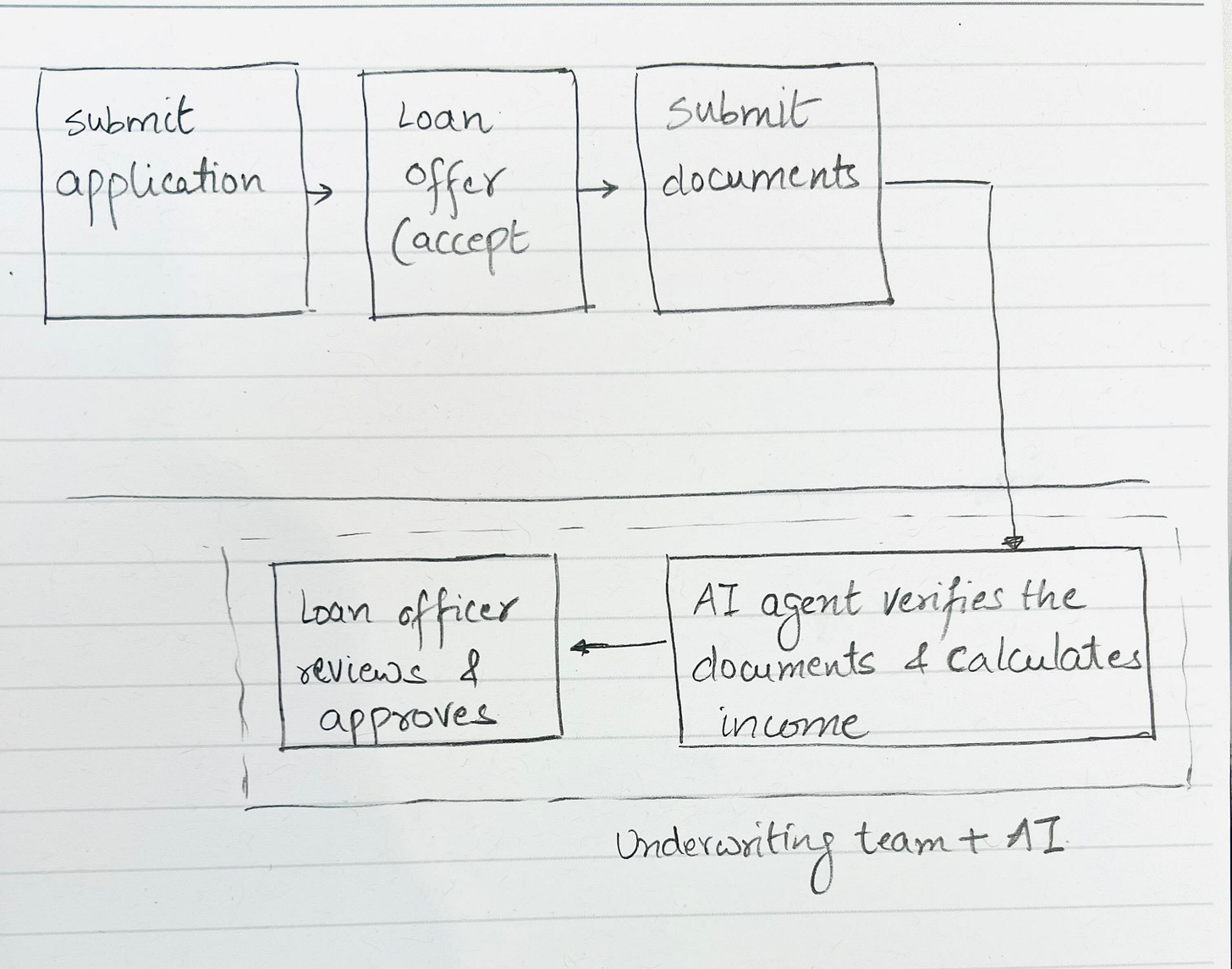

Klarna attributes this to a combination of developments in their underwriting models, product mix, and diversification.

Real-Time, High-Frequency Underwriting: Each transaction receives a new underwriting decision in seconds, leveraging ML-enabled models that analyze proprietary data from ~2.9 million daily transactions.

Small, Short-Term Exposures: Average balance per consumer of just $87 with 40-day average duration (versus $6,730 average US credit card balance and 2.9 years for typical US personal loans).

Improving Model Accuracy: Klarna's Gini score (measure of predictive power) in the US improved from 0.36 in 2019 to 0.72 in H1 2024, significantly outperforming credit bureau models like VantageScore 4.0 (0.35).

Broad Customer Base: Products serve consumers across the credit spectrum while maintaining portfolio quality through dynamic spending limits based on repayment history.

Strategic Underwriting Adjustments: In H2 2022, Klarna implemented stricter underwriting standards including new risk models, increased down payments, and risk-based pricing to improve portfolio quality.

These efforts resulted in credit losses dropping from 9.6% to 1.2% in the US market and 0.47% of GMV in 2024 (overall), even as the company maintained growth.

Cost of Capital

Klarna is also actively changing its funding mix. It is moving towards a bank model and establishing a deposit-based funding approach. That provides a significant low-cost and long-term capital base, giving it an advantage over competitors.

Below are the key highlights from the SEC filing around the changing funding mix:

Centralized Funding Model: Klarna Bank raises deposits and wholesale funding centrally, then distributes capital throughout the group, optimizing capital efficiency.

Banking License Advantage: 94% of Klarna's lending in 2024 was funded through customer deposits, enabled by their banking license - a key competitive advantage.

Deposit Control: 74% of deposits were fixed-term as of December 2024, allowing Klarna to actively manage the duration gap based on interest rate expectations.

Klarna is pushing for more funding through deposits but still maintains flexibility with other sources. Because Klarna’s average term is just 40 days, they can turn capital way faster than companies like Affirm (the avg loan term is 13 months).

Advantages of Klarna’s deposit base + funding mix:

Duration Gap Creates Stability: The average term of deposits (280 days) versus the average loan term (40 days) creates a structural hedge against interest rate fluctuations.

Flexible Funding Mix: While primarily deposit-based, Klarna maintains the ability to tap other funding sources including debt securities (investment grade BBB-/A-3 rating) and synthetic securitizations.

Path to Profitability

Klarna has faced pressure to demonstrate a sustainable business model, which they have responded to:

2019-2022: Significant operating losses

2023: Reduced annual losses by approx. $750 million, approaching breakeven

2024: Continued profitability in early quarters, strengthening its position for a potential IPO

Klarna's profitability comes from several measures:

Improved underwriting: Reducing credit losses through better risk models

Operational efficiency: Significant cost-cutting, including layoffs (about 10% of staff in 2022)

Higher margin products: Shifting focus to higher-margin services

US market growth: Scaling in the high-margin American market (US GMV up nearly 50% YoY in Q3 2023)

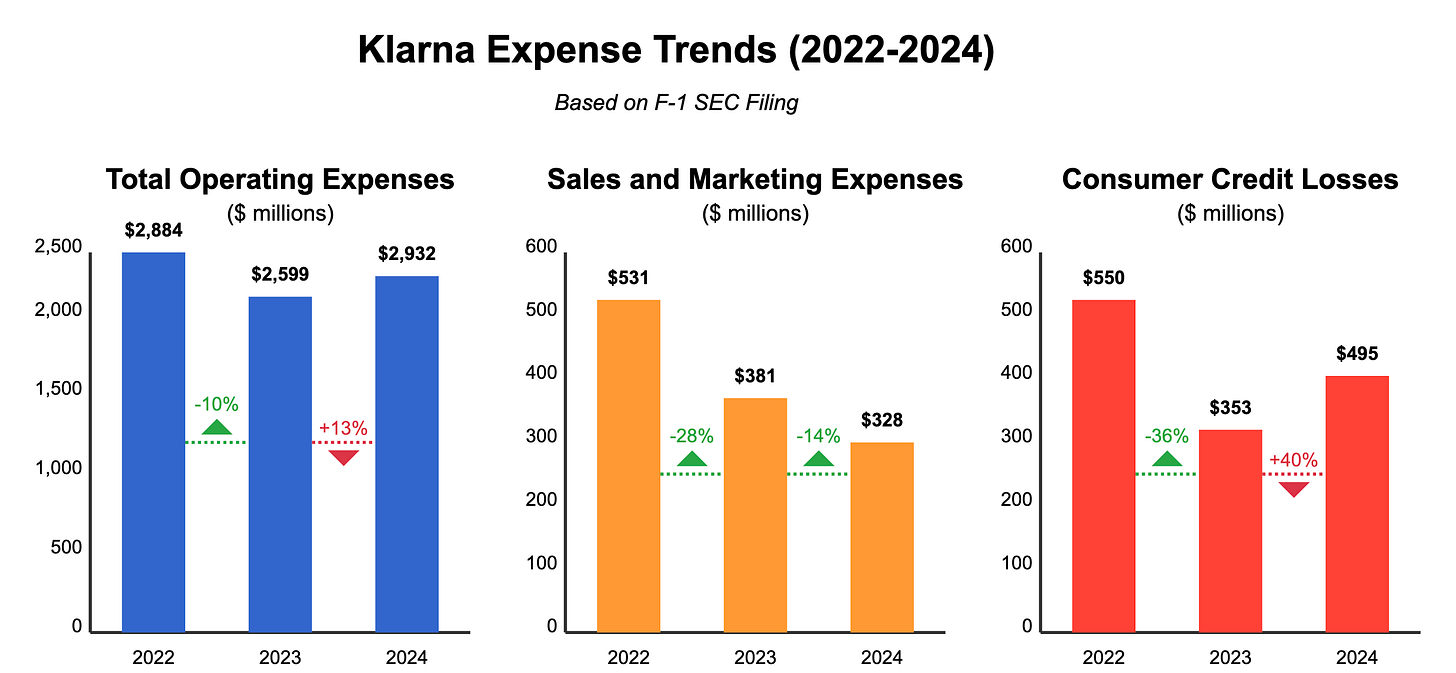

Total Operating Expenses as a % of revenue:

2022: 151%

2023: 114%

2024: 104%

Klarna has systematically reduced expenses even as it scaled active customers and merchants.

IPO and Current Valuation

Finally, Klarna filed for an IPO in the US market, with plans to raise approximately $1 billion.

Reports suggest the company is targeting a valuation of $15-20 billion, which would represent:

A significant recovery from its 2022 low of $6.7 billion

Still far below its peak 2021 valuation of $45.6 billion

A forward revenue multiple of roughly 5.35-7.4x based on 2024 revenue

Comparison with Affirm

Affirm is the closest comparison for Klarna, even though it has a slightly different business model.

Affirm’s primary revenue sources are merchant fees and interest, while Klarna’s 75% of revenue is just Merchant Fees (which they consider as Transaction Revenue).

Below is a comparison across multiple metrics:

Affirm is smaller and growing faster, while Klarna is now profitable.

Klarna is way bigger than Affirm with 90M+ active users while Affirm has 18M+ active users (21M per Feb 2025 news).

Affirm’s revenue is ~8.7% of GMV, while Klarna’s revenue is ~2.4% of GMV

Klarna primarily grew internationally before coming to the US, while Affirm is way bigger in the US and expanding internationally

Recently, Klarna has landed a few big customers like DoorDash and One App (Walmart).

Affirm’s market cap is ~$15 billion (as of March 21, 2025), and Klarna is seeking the same valuation.

It’ll be interesting to see how public investors value the company when it goes public in the next few weeks.