Using AI in Underwriting: Borrower Income Calculations

Income calculations are complicated when error tolerance is low. Increasingly, borrowers have multiple sources of non-standard income which further complicates. How can AI help fix this?

For lenders, calculating income is one of the most important but overlooked aspects of underwriting. Calculating income can take hours depending on the company and the type of customer. Some companies build up to 20 different income calculators. They use these different calculators based on who is applying for the loan. And they maintain updated versions of each calculator whenever they update their underwriting procedures.

It always sounds simple when a lending company states ratios like “debt to income” or sets income cut-offs in credit policy. But it’s complicated behind the scenes. That’s why, sometimes, portfolio performance varies significantly even with similar lending policies.

Credit risk and operations teams spend a lot of time getting the calculations right. When operations teams ask for documents in a piecemeal way, it also leads to a poor user experience.

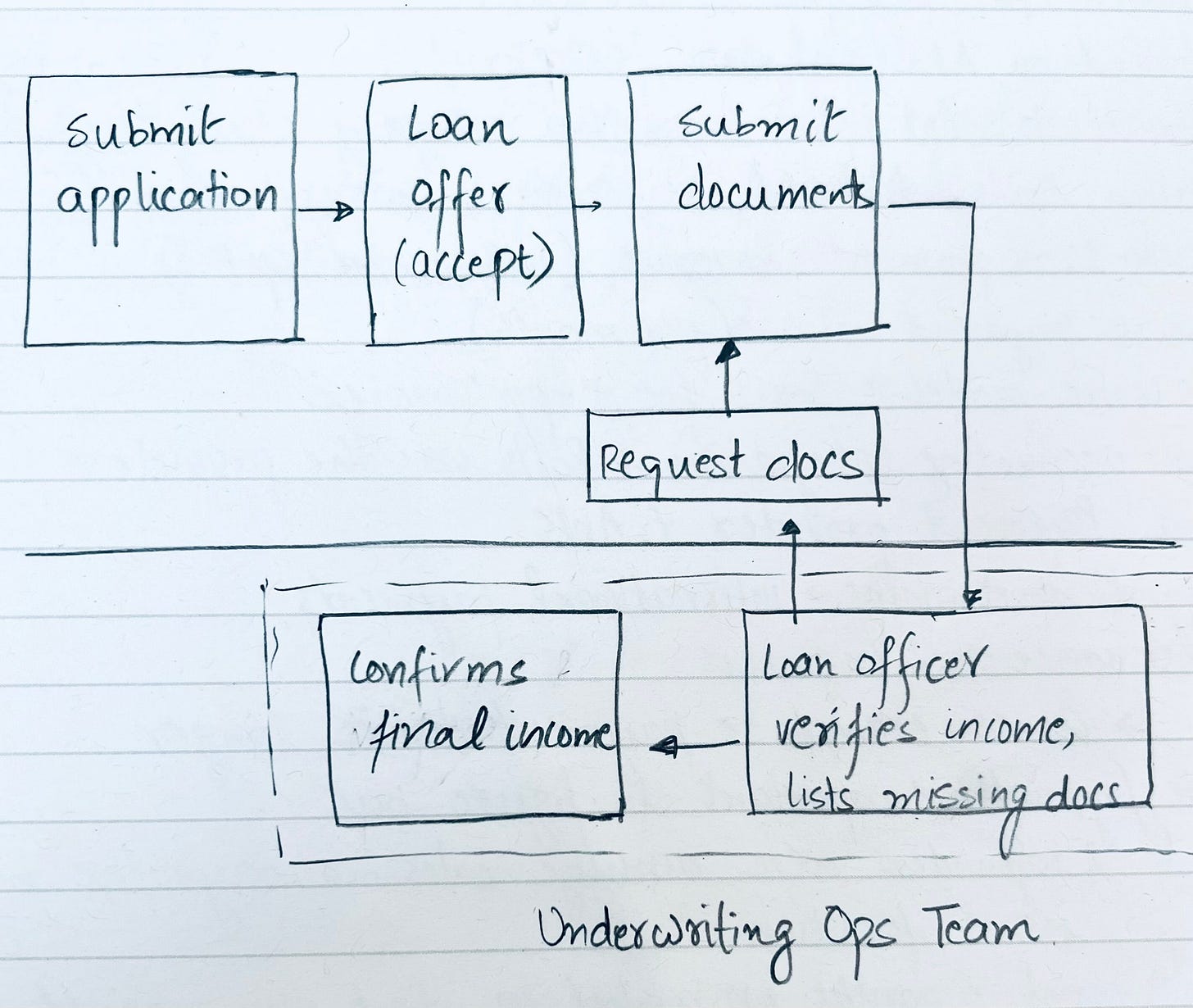

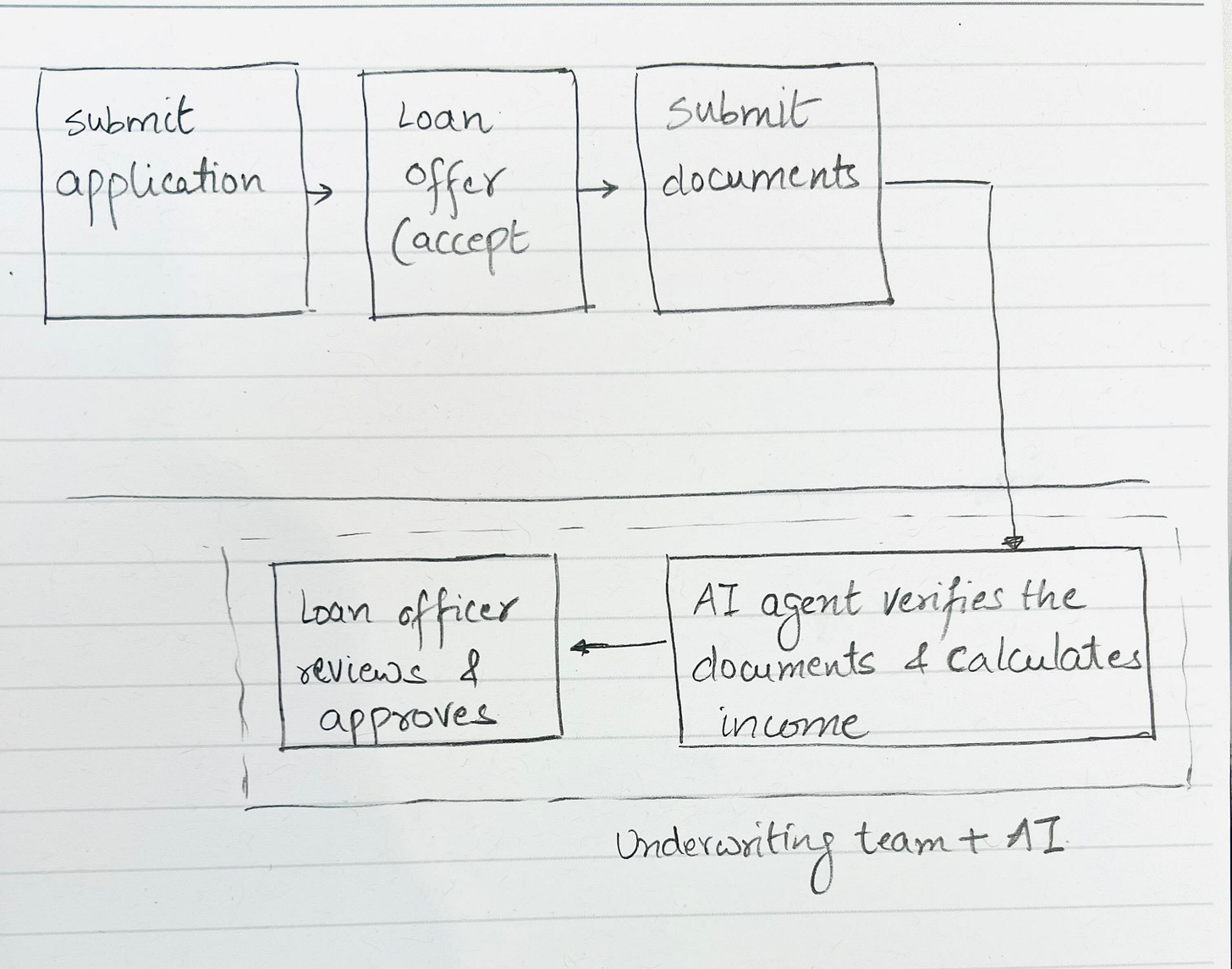

The way an origination process works is:

submit a loan application

accept loan offer

submit documents for verification

loan officer reviews the documents, triangulates and calculates income, figures out they need more documents, and asks for more documents to get accurate income

submit additional documents

the document submission process repeats

This should be, ideally, a single-step document submission process. The loan officer should be able to calculate income and list all the missing documents the first time.

AI can help calculate accurate income in the first pass and reduce this back and forth.

This is only applicable if calculating accurate income is important for your credit underwriting processes. You can automate income calculations if you have a high tolerance for error or if you are conservative in your loan offers.

Real lenders focus on accurate income calculations. e.g. mortgages.

During mortgage applications, underwriters collect an insane amount of documentation to calculate your income and free cash flow accurately.

You must comply with federal income calculation guidance in loan products like mortgages because they only buy eligible loans.

You may not appreciate the nuances unless you spend years in the depths of income calculators. Building and maintaining standardized, unbiased, accurate, and fast income calculators takes significant effort.

Similarly, underwriting workflow is one of the biggest areas of innovation in SMB lending. Startups are helping reduce errors and increase the speed of underwriting. Automating this is even more critical with embedded lending.

Overall, this is a huge pain, and I think using AI could be a potential solution to this problem.

Unpacking Income Calculations

Let’s review why income calculations are time consuming and tricky to get right. We’ll use mortgage income calculation as an example for this exercise.

Almost all mortgage underwriting is still completed manually. Because of the detailed and complex nature of underwriting, applicants have to submit tons of documentation for income calculation (and verification).

Selling mortgages to Fannie has strict income calculation requirements. Based on Fannie Mae’s website, for originating compliant mortgages, lenders have to complete the following:

Income Assessment

Asset Assessment

Credit Assessment

Liability Assessment

In this post, we’ll focus on only income assessment.

Assessing income for mortgage origination has a few components:

Income sources

Document verification

Income calculation

Income stability

In certain cases, lenders are required to consider income sources from many sources:

Base income (W2)

Bonuses (W2)

Hourly (1099)

Commissions (1099)

Overtime (1099 or W2)

Gig economy (1099)

Military income

Tips (1099)

Government assistance

Alimony or Child Support

Cash deposits

Venmo, Zelle, etc

Rental income

Dividend income

Interest income

Capital gains

Foreign income (sources that are outside the US)

Social Security

VA benefits

Retirement income

Pension benefits

Seasonal income

These are the majority of the types of income that could be submitted by the applicant.

Given applicants are increasingly working multiple jobs, there’s a lot more to parse through in their loan applications. With household income, income sources are exponentially more complex to calculate.

There is also variability in the frequency and consistency of these income sources. Below are a few examples:

Bonuses could be paid every month, once a quarter, or annually

Overtime could be inconsistent every month

Gig economy workers could be paid daily, weekly, bi-weekly, bi-monthly, or monthly

Hourly workers could receive bonuses based on hitting certain milestones

Some positions may offer sales commissions which could be paid infrequently, like monthly or quarterly

Rental income (or from sites like Airbnb) could be seasonal

Each income source can be proved with multiple types of documents. Based on your credit policy and underwriting procedures, you have to collect documents for all these income sources. It could quickly become complex once you consider all the sources of income and the ways they could be paid.

The applicant may switch jobs or work with multiple companies, so the applicant needs to submit this information from all those sources.

Depending on the income type, lenders may need to collect documents going as far back as 24 months. One can easily imagine the work needed to collect and verify these income documents. The amount of documentation needed to verify income sources across multiple bank accounts could be a nightmare for even the most experienced lenders.

Operational procedures could be complicated because of the significant variability in these documents. New hires need to be trained in these complex verification procedures as your team grows. Balancing customer experience, processing timeline, accuracy, and fraud gets tricky.

Fannie Mae has given guidelines on documentation needed for each type of income. Below are a few examples:

for commission income, they suggest collecting the last 24 months, but 12 months could also suffice as long as there are positive factors that compensate for a shorter history

for secondary employment income, different employers are acceptable as long as income was consistently received without more than 1 month gap across jobs in the last 12 months

for self employed income (where the applicant owns more than 25% of the business), they need to submit more documentation per the self employed documentation requirements

rental income is acceptable if it is established that it’ll continue, if yes, then form 1007 or 1025 (as applicable), and either most recent federal tax returns with Schedule 1 and Schedule E or copies of the current lease agreements

After you determine all the income sources, collect documents, and verify them, you have to clean the data and calculate income. Each type of income needs to be annualized and then evaluated for stability, consistency, and predictability.

Lenders are asking a few underlying questions:

What's the pre-tax or post-tax monthly income?

What's the free cash flow?

What's the stability of income?

What is the predictability of income?

Extracting and cleaning the data has its own set of challenges. OCR tools help make things easier and faster, but it’s still time consuming to check completion, validate documents, and verify outputs.

With this context, I will discuss how AI can help improve income calculations.

Automating income calculations for consumers

In consumer lending, accurate income calculations can mean the difference between a successful loan repayment and a default. Collectively, it can mean millions of dollars in losses. Being too restrictive in tolerance and calculations can also cost hundreds of millions in loan originations or adverse selection. The right balance between accuracy of income calculations and customer experience is core to building a successful loan portfolio.

Even with all the advanced tools around income calculation, a large percentage of income calculations are done manually. There are 4 steps to calculating income correctly.

Collecting documents

Verifying data

Cleaning inputs

Calculating income

AI can help with each of these steps. It can help reduce friction in collecting information from applications, increase accuracy and speed of document verification, help find areas of missing information, clean inputs, and finally, automate income calculations.

Let’s see how AI can help with each of these steps.

Collecing documents

AI can help collect complete and accurate documents in real time. Fine tuned models can process uploaded documents and provide feedback based on missing information.

AI can:

generate automated emails requesting missing documents.

highlight incomplete information or mismatches in uploaded documents

detect duplicate document uploads

check whether uploaded documents meet specific criteria, such as being within a recent date range or containing required signatures, and request re-uploads if necessary

These are some of the benefits of improving document collection from applicants.

Verifying data

Given we expect growth in fake documents, credit policies with become tighter. AI can help us verify information faster and reduce fraud. AI tools can automate most of the matching work while underwriters review the final output and sign off on the output. In verifying data, AI can:

assess documents for authenticity by identifying indicators of manipulation, such as unusual fonts, pixel inconsistencies, or incorrect metadata, further reducing the likelihood of fraudulent submissions

give underwriters a clear, concise view of each applicant’s profile, highlighting any potential red flags or areas requiring further investigation

apply policy cut offs and ask for more documents as needed e.g. if 4 most recent paystubs are needed and the applicant uploads only 3, AI can give feedback in real time

cross-reference information across multiple documents (e.g., comparing tax returns with bank statements) to ensure consistency and flag any discrepancies for review.

automatically classify documents by type (e.g., W-2, bank statement, tax return), making them easy to locate and reducing manual sorting

Real time verification of uploaded documents could be one of the biggest benefits of using AI. This goes beyond companies providing document OCRs.

Cleaning data

Uploaded documents are incredibly messy. Until you have seen the wide range of information uploaded by applicants when applying for loan, you don’t comprehend the benefits of automation. The clarity of your instructions doesn’t match the quality of uploaded information. Getting clean data to work with is one of the biggest time savers for underwriters. For this area, AI can:

extract key pieces of information depending on the type of document; because AI can classify the document, it knows how to extract the right pieces of data from the document

combine data from multiple documents to build a clear picture for the underwriters

translate documents in the right language if the uploaded documents are in different languages

convert different payment frequencies (e.g., biweekly or weekly) into a standardized monthly income, providing an accurate, comparable view of income across applicants.

clean and standardize applicant details (e.g., formatting names, addresses, and dates consistently), ensuring data accuracy and reducing confusion due to typographical errors or varying formats

automatically check for typical errors or inconsistencies (e.g., incorrect Social Security numbers, invalid dates, or mismatched names across documents) and flag these for correction, improving the data’s reliability

Accurately extracting the correct information from documents is a time consuming task. Even though there are tools available in the market, we still have a long way to go towards automating data cleaning for underwriters.

Calculating income

Finally, AI tools can help put all this together, and the output can be used to calculate incomes. It’s relatively straightforward.

Incomes from various sources are annualized and discounts are applied based on consistency, sustainability, and predictability.

e.g. rental incomes may be discounted by 50% if they are recent or have been fluctuating over the past 2 years

To annualize incomes, dates and income amounts should have be extracted correctly. After this, the system calculates the income as needed.

Then all the income sources are added to get the final number.

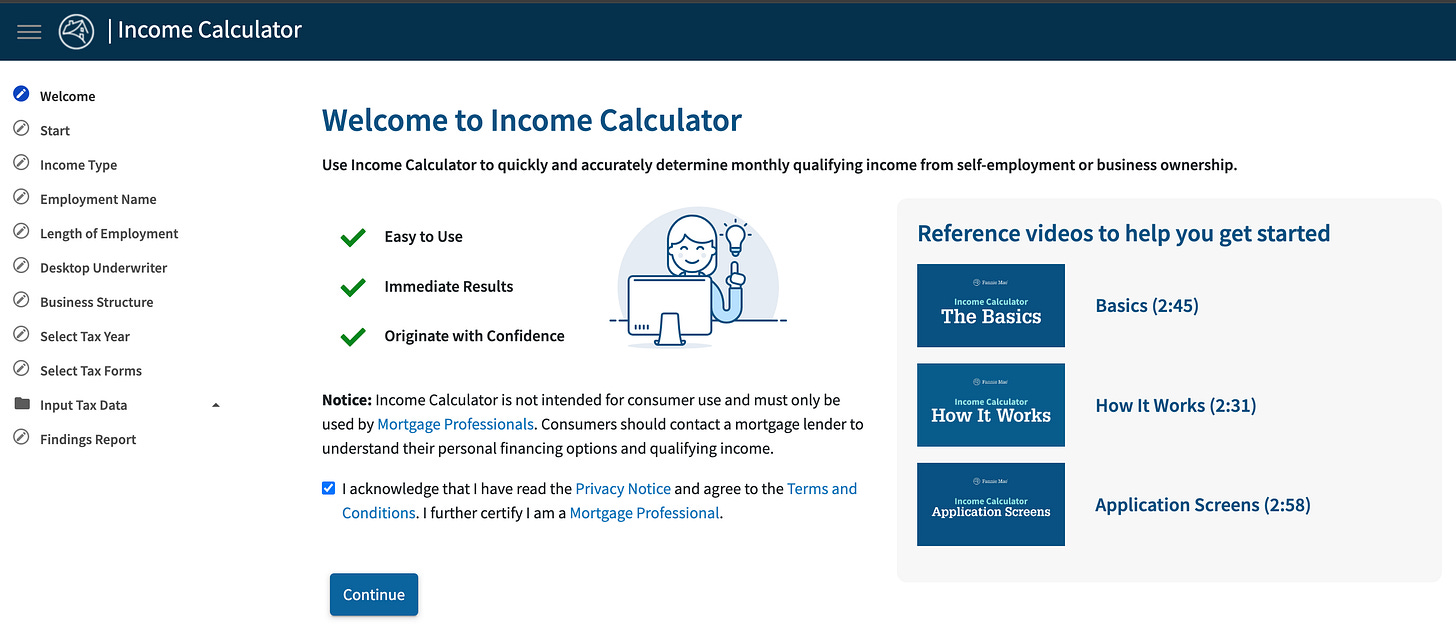

There are standard income calculators after you have extracted the information. Here’s the Fannie Mae income calculator.

By using AI in all of the above steps, I think lenders can reduce income calculation costs and time by 50% - 75% (if not more).

Hope this helps you get a better overview of how AI is transforming operations at fintech companies.