Building large embedded lending businesses (consumer and SMB)

How to think about building an embedded lending company that could go public. There have been big companies in embedded consumer lending but not in SMB. Why is that the case?

Embedded lending has been around for as long as online lending. One of the first examples of this was “BillMeLater” which was started as I4 Commerce in 2000. eBay acquired it in 2008 for $820M in cash and $125M in options (approx $1 billion). It now lives on as Paypal Credit, a Buy Now Pay Later product.

There’s a reason why Max Levchin decided to build Affirm.

Since the recent iteration of embedded lending (BNPL) emerged, 2 companies have gone public - Affirm and Afterpay. Both are consumer focused. To the best of my knowledge, no embedded business lending companies have gone public. Embedded payments have been a much bigger success in SMB compared to embedded lending.

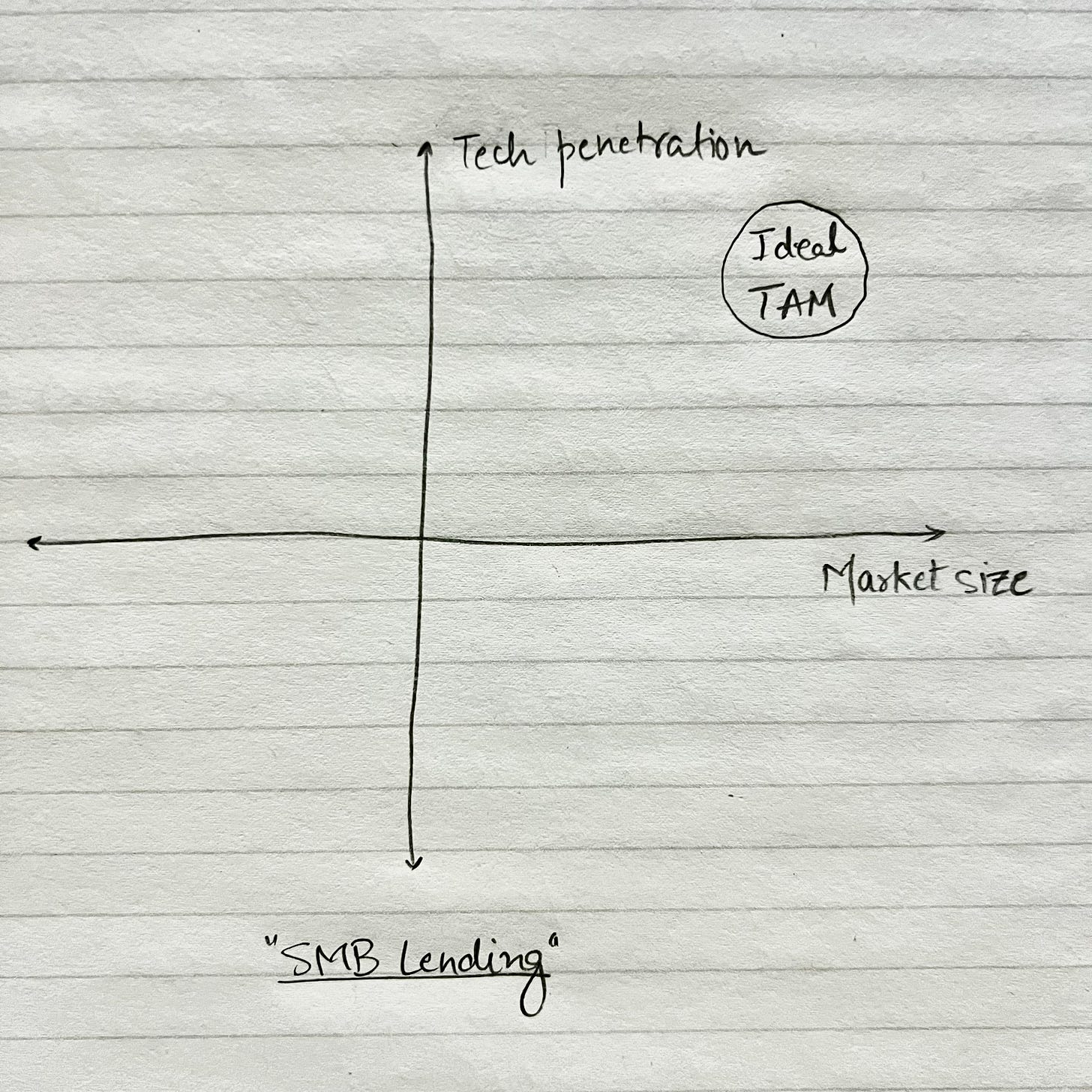

This raises the question: Why are there no large embedded business lending companies? Why haven't SMB lending businesses gone public?

It's not due to market size - business lending volume far exceeds consumer lending.

It's not because of a lack of technology - more technology is embedded in various industries than ever before.

It's not due to a lack of market need - businesses are as hungry for capital as they have been in history.

There’s something missing in the embedded SMB lending business because of which we haven’t seen any big companies.

Embedded Lending

To understand that, let’s start by breaking down the value proposition of embedded lending companies. Embedded lending companies perform a few key tasks:

Underwrite

Originate

Lend

Service

Collect

The biggest difference between an embedded and a direct lending company is customer acquisition.

Direct to consumer lenders (like Lending Club) spend money to acquire customers through direct marketing, while embedded lending companies like Affirm partner with merchants for acquisition and have $0 variable CAC.

In a way, one of the oldest forms of embedded lending is getting an auto loan at the dealership. The dealer only shows you lending options from other lenders and you make payments directly to that lender (generally a bank).

BNPL is the most common form of embedded consumer lending in the modern world. In some cases, lenders offer equal payments without interest; in other cases, they charge interest.

Embedded Consumer Lending

Here’s how the process works for embedded lending:

Choose a product to buy (could be a mattress, exercise bike, etc.)

Choose the payment method (pay using a BNPL lender, make payments in installments)

Fill out an application form (basic information to determine creditworthiness)

Complete the purchase (if approved, accept the terms of the payment)

Make payment directly to the lender (usually automated ACH or debit card payments)

The purchase is completed in the same session.

The conversion funnel looks like this:

10,000 purchasers → 100 loan applications → 50 approvals → 25 conversions

The conversion rate is 0.25%.

However, because of the large volume of e-commerce customers, even low conversion rates add up to big numbers.

Combined, these 3 companies originated ~$150 billion in 2023. And probably worth $25+ billion even after the market crash.

This is just one product line - closed-end unsecured consumer credit. If we add products like credit cards and auto loans, they would add up to hundreds of billions in additional originations.

*I’ve excluded companies like Pagaya and Theorem because they are second-look programs, not embedded lenders.

Embedded SMB Lending

Let’s use the same lens for embedded SMB lending and start by looking at lending products.

While consumer loan products are generally installment loans with or without interest, small business lending has multiple products.

Below are the common lending products for small businesses:

Merchant Cash Advance: pay a percentage of future sales until the balance is completely paid

Invoice Factoring: business sells its unpaid invoices at a discount

Loans (secured or unsecured): monthly installment payments for the principal and interest (closed end)

Lines of Credit (secured or unsecured): revolving lines that can be drawn as needed until the max limit (could also be used as working capital)

Most non-bank SMB lenders focus on merchant cash advances and invoice factoring, while banks focus on loans and lines of credit. However, generally, non-bank lenders and banks offer all products to a certain extent.

Note that embedded SMB lending is also termed Vertical SaaS embedded lending.

In embedded SMB lending, captive lenders have been generally bigger than third-party lenders.

Shopify Capital, Stripe Capital, and Square Capital are probably some of the biggest captive embedded lenders. All of them lend only to businesses that are using their respective products. For example, Stripe lends only to businesses using Stripe as their payment processor.

Companies like Clearco (started in Canada), and Kabbage (sold to American Express) are direct business lenders.

There are not many embedded business lenders. None have been public.

A few new upstarts like Parafin ($94M raised) and Kanmon ($9.2M raised) offer embedded lending solutions. But they are still fairly small.

Pipe was valued at $2 billion in 2021 during boom times, but they are only a fraction of their value at peak.

Slope** is also gaining traction ($78M raised) with enterprises and lending to small businesses through those enterprise partnerships. Their approach has been to sign up big enterprise partners who help get access to SMB customers. Slope has to do a good job at underwriting these businesses.

As of now, there are no standalone $1B+ embedded business lending companies.

Why are there no large embedded SMB lenders?

I believe the reason is that businesses comprise many smaller markets, at least smaller than the consumer market.

The advantage of lending to consumers is that you can underwrite the whole population in the same way based on a couple of universal variables like Credit Score and Income.**

The same is not true for SMBs.

Small businesses are as different as they could be based on their vertical and size. They have different operational structures, income sources, margins, seasonality, etc. e.g. construction businesses operate differently than restaurants that are different than e-commerce businesses that are different than accounting firms, and so on.

That’s why specific tools and products exist for each vertical.

When a new SMB embedded lending company launches, it starts by focusing on a vertical. e.g. Toast started with restaurants, Stripe focused on e-commerce businesses, Square started with mom and pop small businesses, and so on.

The products (payments or software) were built specifically for that vertical. And the underwriting models were also specific to that vertical. This hyperfocus is needed for an initial wedge. Then the company expands that wedge, moves upmarket, and adds robust functionality.

The problem is that the infrastructure for one vertical doesn’t expand to other verticals. Underwriting built for construction companies doesn’t work for e-commerce companies.

This creates a natural limiting factor for growth and scale.

To expand to other verticals, a company has to build new software for a different vertical from *almost* scratch.

The company’s lending business remains sub-scale if its launch vertical is not a big market. The competitive forces don’t allow the company to build a great second product.

Another important factor to consider is that SMB verticals can only go as fast as software adoption for that vertical.

That’s why picking a big market for lending is more important for SMBs than consumer businesses.

Eventually, the biggest software companies in any vertical become captive lenders (as we have seen with Shopify, Stripe, Square, Toast).

Still, originations by captive lenders are a small number compared to consumer lenders.

Toast Capital hit $1 billion in annualized originations in 2024.

Square Capital did $4.78 billion in loans in 2023.

Shopify had $719 million in outstanding receivables at the end of 2023.

Because Stripe is private, we don’t know their origination volume. But Stripe processes $1 Trillion in payments every year. They are big enough to build a large captive lending business. That hasn’t happened yet.

Now compare $150 billion in originations of the top 3 embedded consumer lending companies with $6 billion in loans for the top 3 embedded SMB lending companies.

Even though the SMB lending market is arguably bigger than the consumer unsecured personal loan market, there are no big lenders in the SMB market.

To scale an embedded SMB lending business, one needs to build unique underwriting for various verticals in one platform. This can only be done by going after one vertical at a time.

A way to bypass this could be AI. AI can help manage the complexity of underwriting different types of businesses. Because business lending has less oversight than consumer, lenders can build models that don’t need to be explained to regulators. AI can also help with extensive operational automation needed in business lending.

Hope this gives you a framework for thinking about embedded lending businesses.

**It’s tricky for lenders to move across credit spectrums but each credit spectrum is big in consumer. e.g. SoFi is not big in subprime credit and CapitalOne isn’t big in super prime. A billion dollars worth of origination could be done in each FICO score point.

**I did not use funding raised as a metric for success. Embedded consumer lending companies would also win on that metric.

***I am an early investor in Slope.

Great article Rohit and very true. Businesses are much more heterogeneous vs consumers which makes underwriting more a challenge but by using data from the platform to underwrite these businesses, there is also an interesting underwriting advantage that can be built to better service these customers.