Where does value accrue in public fintech companies?

We think of fintech as a giant monolith but it has many sub-verticals like lending, payments, banking, insurance, etc. Let's have a look at the winning and losing sector(s) in the public market.

Recently, I was taking a deeper look at “what really drives value creation in fintech” for founders and investors.

My theory has been that public markets are tough on pure fintech companies.

Private markets valuations are still dissociated with how companies will be valued when/if they go public. Acquisitions by entrenched players is the most common exit path (also true for everything in tech). But I still wonder about the multiples of these acquisitions.

Public markets are my best window into potential multiples for these deals (particularly late stage).

So I decided to look into how various fintech verticals have performed in the public markets.

If you are looking to start a fintech company, it’s worth paying attention to the sectors that have produced big exits. Public market performance is a big factor for venture investors when evaluating potential investments. This will help you guide your expectations on multiples and potential exit options.

And I used F-Prime Fintech Index* for a list of public fintech companies.

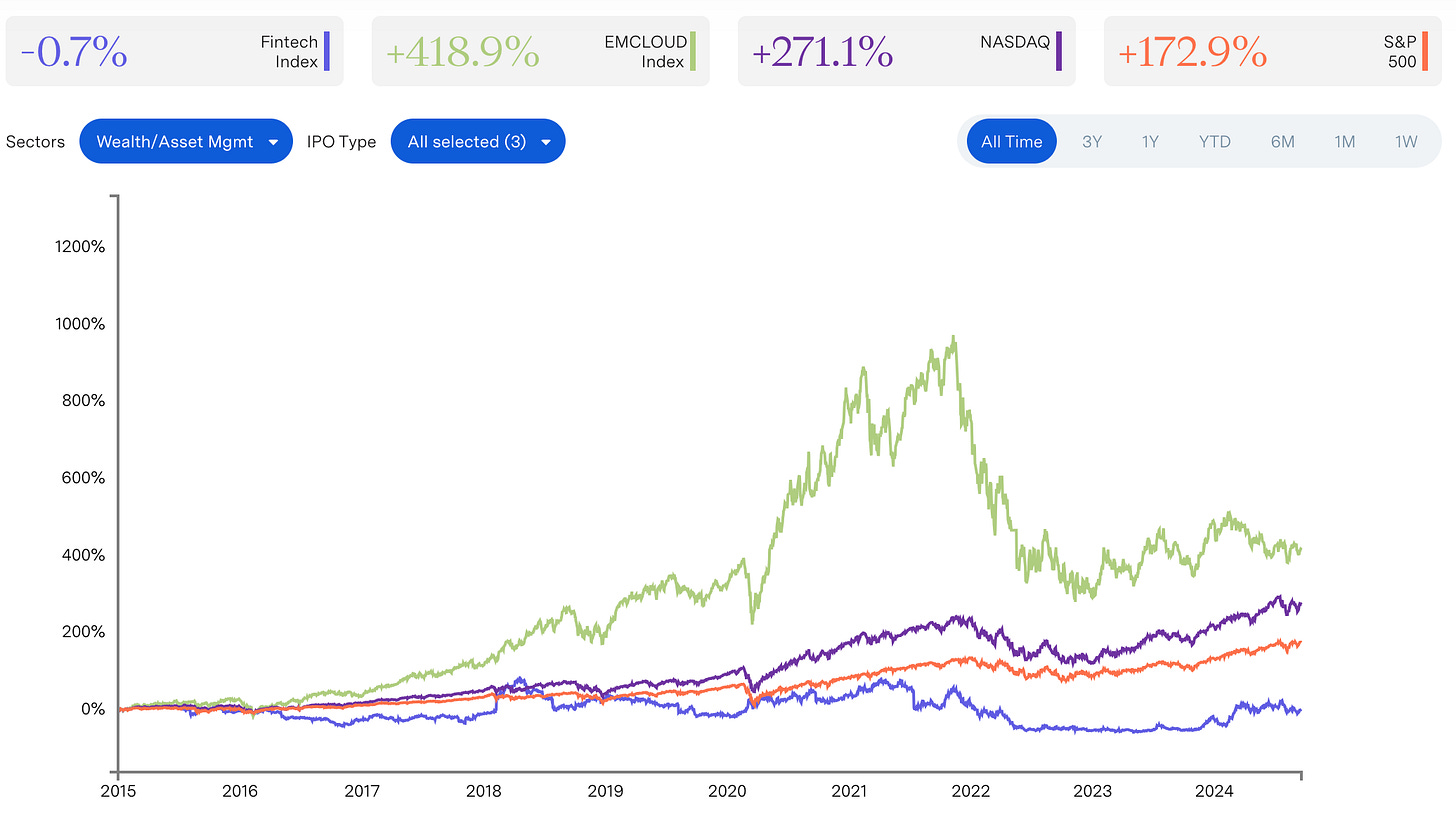

According to the index, fitnech companies have outperformed major indexes and ETFs (EMCLOUD, NASDAQ, and S&P).

Fintech Index: +694.9%

EMCloud Index: +418.9%

NASDAQ: +271.1%

S&P 500: +172.9%

Fintech Index has 51 companies across 7 sectors (Insurance, Payments, Banking, Lending, B2B SaaS, Wealth/Asset Mgmt, PropTech).

Let’s look at the performance of each of these sectors:

Insurance: -24.9% (6 companies)

Payments: +1,017% (19 companies)

Banking: +63.5% (6 companies)

Lending: -52.4% (4 companies)

B2B SaaS: +320.8% (8 companies)

Wealth/Asset Mgmt: -0.7% (4 companies)

PropTech: -55.8% (4 companies)

Only 2 sectors have done better than the market. Really one sector.

And that’s Payments.

In this exploration, I am obviously not looking at the performance of venture investors and valuations of private companies. Many are doing well that are not yet public.

But public market performance drives how late stage private companies are valued.

In fintech, there’s a clear separation of public market performance by sector.

Payments has the most number of companies (19) and the only sector that continues to outperform.

Payments outperformance is outsized because some companies became fintech companies later.

e.g. Shopify. They didn’t do payments for a while and the investment wasn’t led by fintech partners.

MecardoLibre - started in 1999, is an e-commerce company, and recently considered a fintech.

These 2 companies are the main reason that Payments sector is up 1,000%+.

If you take these 2 companies out, the performance would be significantly lower. It’s totally fine to have a couple of winners in a portfolio but these 2 massive winners were not originally fintech companies.

Nubank has been a massive outcome for venture investors but hasn’t *yet* performed great in the public markets.

Having said that, the last few years have been volatile (particularly for banking and lending companies). Maybe they’ll bounce back in the next few years with rate cuts.

Worth mentioning that many private fintech companies have high valuations (who raised during the pandemic), but only a few of them have raised at reset valuations in 2023 and 2024.

Most companies have also been payments companies like Stripe (at $70B) and Ramp (at $7.65B). e.g. I can’t remember any banking company that raised a round recently. Aven is close with their raise at a $1B valuation.

The question I ask myself: where does the value accrue in fintech?

At least in the public markets, using fintech for monetization has worked better than being a “pure fintech” company.

Probably that’s why “enabling fintech monetization” has been on of the key investment areas for VCs. This takes the form of B2B SaaS.

Most VCs have pulled back from investing in consumer fintech (particularly banking and lending) and it makes sense.

The bar for consumer products is way higher than before.

Most of the current public B2C banking/lending companies that were started in 10+ years ago are thriving. Below are a few big companies and their start year:

Affirm - 2012

Nubank - 2013

Chime - 2012

Robinhood - 2013

Coinbase - 2012

Opendoor - 2014

SoFi - 2011

Upstart - 2012

Monzo - 2015

Revolut - 2014

Founders look at big consumer fintech companies and want to start another one. But they need to think deeply about their differentiation. You can’t expect to build a large company by being similar to companies that were started 10 years ago and grew with the market. You need to figure out your own trend in today’s world.

And when you launch a new product, you need to reach escape velocity quickly.

B2B SaaS is also an interesting story, most of these companies were started 15 years ago. It tells you the time it takes to build a business a B2B company in fintech. There are 8 companies in the index, they were all started at least 15 years ago. A few of them started 24 years ago.

Envestnet - 1999

Xero - 2006

Q2 Holdings - 2004

Blackline - 2001

Bill.com - 2006

Alkami Technology - 2009

Intapp Inc. - 2000

Expensify - 2008

No company is currently $10B+ market cap.

Private companies are certainly worth a lot more. But public market comps are not generous.

Private market investors have made great returns investing early in these companies.

When starting a fintech company, know that it’s a long haul and you have to build with better fundamentals than other industries. It’s not the easiest sector and public markets are tough.

*The index is focused on startups that went public. It excludes companies like Visa, Mastercard, etc. Also includes all the banks.