How Onbo grew to $2.5M+ in revenue from billboard ads

At Stilt, we launched a Credit as a Service product in 2022 called Onbo. Sharing my learnings from growing an innovative fintech product from $0 to $2.5M in 6 months.

Onbo grew to $2.5M+ in revenue in 6 months post launch. We announced the fundraise and product in March 2022. By then, we had only a few customers in the pilot phase. After the launch announcement, we took a few interesting steps that made Onbo popular.

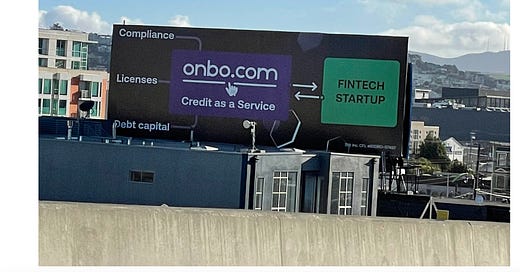

The biggest one was using Billboards as our first marketing channel.

This single, unpopular at the time, decision gave us the highest leverage for less than $250k.

Let’s start with a background of Onbo:

Onbo was built by Stilt.

Stilt was a consumer fintech company. In the 5+ years, we had originated hundreds of millions of unsecured loans. To grow this lending volume, we built a vertically integrated platform.

Because we built all the key pieces of technology in house, we productized it in a way that other companies could also lend using this technology.

Similar to how Amazon built cloud technology for internal use and then productized it as Amazon Web Services (AWS).

Our AWS was Onbo.

Techcrunch Announcement

We had raised a $14M Series A and a $100M debt facility around the same time.

We announced the fundraise and product launch in TechCrunch.

Techcrunch launch got us a few inquiries but the product was still not known.

For context, this was a core infrastructure product for the buyer. If this product didn’t work, our customers and their end users would massively suffer.** So the bar for buying the product was high.

Onbo’s customers had to trust our team’s expertise and the quality of the product.

Techcrunch couldn’t provide that trust.

Right Acquisition Channel

We evaluated multiple channels. Our investors wanted us to start with paid channels like Google, Facebook, Cold Outreach, etc.

Picking the right channel was very important.

It was not immediately obvious to many but billboards were the right choice.

Almost everyone we talked to thought it was a waste of money.

There are always negatives to every acquisition channel. We had to weigh the pros and cons and be thoughtful about the sequencing.

Negatives of using billboards:

No targeting

Expensive to test

No attribution

No iteration

No real time feedback

I can add even more negatives when using billboards as a channel at launch.

But it was the right fit for our product.

Billboards shrunk the time to trust.

Most of our competitors relied on paid ads, social media, and cold outreach. They had to grapple with all the noise of buying a complicated product using 10 blue links.

We understood the value of a channel that’s not utilized by most. Even after the success, most people were stuck asking “What’s the attributable ROI.”

The reasons we launched with billboards:

Establish trust (immediately)

Rise above the noise

Build a brand

Closely geolocated customers i.e. startups

Start a conversation (within fintech)

High ACV (annual contract value)

No clear keyword targeting (on paid channels)

Billboards also forced us to synthesize our value proposition in a few words. This was super valuable when talking to potential customers.

Onbo also became a part of the conversation when potential customers were talking to competitors. This also gave us a chance to pitch even if our leads were talking to others.

Reception

The impact of this campaign was positive and far reaching. We got a jumpstart.

We received hundreds of leads and tens of partnership conversations.

None of our competitors had ever used them. Everyone was surprised by this move. Which also gave us the confidence that it was the right move.

Partners trusted a brand that is advertising on billboards more than someone only advertising on Google Ads.

We also received multiple emails and messages like this.

Cost and ROI

We used Clear Channel as the advertising partner. We advertised only in San Francisco.

Our package consisted of 32 billboards (pre-decided locations), 2 on the freeway, and 75 bus stops.

Our total cost for the campaign was less than $250k.

Here’s the breakdown:

32 City billboards: $160,000

2 Freeway billboards: $43,000

75 Bus Stops: $37,500

Total: $238,500

We also had production costs for materials, which was another $24,362.75.

Although there’s no attribution of revenue from the billboard ads, there was a clear correlation in metrics like website visits, new leads, time to close, branded keyword searches, etc.

We were improving with every new customer but billboards added a layer of trust that would’ve taken years to build. Billboard ads pulled us at least 2-3 years forward in the market.

We were at less than $500k in contracted ARR, and within 4 months of billboard campaigns, we hit $2.5M+.

Onbo was also the reason we had conversations with potential acquirers.

The real benefit of that is immeasurable.

Learnings

We learned a lot running our first billboard campaign. It was the best campaign in terms of ROI across all channels and all the products we launched at Stilt.

We had to convince investors and others that it was the right move for a new product.

Below are some of the learnings:

1. Product-Channel Fit:

Be thoughtful about what channels give your product an advantage over others. Picking the right channel makes all the difference.

Be it billboards, ads, or referrals, make sure that your product is presented in the right light.

2. Decide Metrics for ROI:

Traditional metrics don’t work for all channels. If your team is stuck on only the metrics they know, think of the right ones that will show the return on investment.

Metrics like branded searches have a positive impact that may not be visible right away. Make a list of metrics that fit your marketing channel and track them.

3. Don’t Follow the Crowd:

Your CAC is your winning strategy. To manage your CAC, you need to go to places where your competitors aren’t. You can also be the first to exploit a new channel. Everyone who follows after will walk in your shadows.

Don’t hesitate to try innovative channels especially if your competitors haven’t tried them.

**Fintech folks working in banking/credit have seen the negative impact of the dissolution of Synapse.

Hope this helps when you are evaluating acquisition channels for your product.