Analyzing Upstart's S-1 filing

Upstart recently filed for IPO. Here's our take on product, growth, competitors, business moat, and valuation.

Upstart Holdings, an online lender recently filed their S1. This is the first blog post that I have collaborated on. It was too good to pass up collaborating with another Rohit :). Y'all are in for a treat, it's a 2-Rohit’s-for-the-price of one analysis!

What is Upstart?

Upstart is an online consumer lender and a lending technology provider. Their core differentiation is that they use Artificial Intelligence for lending decisions. Upstart claims that this results in automated disbursals, higher approval rates, better risk-adjusted performance, and reduced fraud. Their main customer interface is via its website www.upstart.com and through bank partners. Currently, their cloud lending platform is available only in the US. Software is eating the world, but in a financial services business, the product is always money. Upstart is an online lender first. They have operated a lending platform for years and now pivoting to providing a SaaS (ish) platform for banks.

High level stats:

622,000 loans transacted

$3.5B in loans originated between Apr 2019 to Mar 2020

70% of loans are fully automated in 2020 (until Sep 2020)

75% reduction in loss rates (with same approval rates)

Is there an underwriting edge?

Lending at its core is about underwriting. Let's walk through how Upstarts positions its underwriting.

Upstart’s online loan application differs from other online lenders as they use details around education and employment for underwriting. They look at holistic consumer profiles to offer rates better than predictions based only on credit reports (FICO scores). From what I see, they still use FICO in their underwriting but improve on it based on alternative data.

Upstart shares 3 proof points for their better models:

Upstart claims that they can approve 2.7 times as many borrowers for banks while maintaining the same default rate.

They did a study with CFPB that claims Upstart approves 27% more borrowers at 16% lower average APR.

For pools of securitized loans, their realized loss rates were half of those predicted by Kroll (a prominent credit agency).

Upstart claims to have fully automated origination for 70% of the loans and attributed that to improvements in AI models. This is important for Upstart as automation provides significant leverage in the business model. If Upstart keeps operating costs low, they can earn high gross margins as they scale. We should make sure that the quality of verification isn’t lowered because of automation. As more banks use the platform, the requirement for automation is also lower because most banks only lend to their customers (who are already verified).

Upstart has 2 flywheels - model accuracy and borrower selection. In lending, more data improves models but the improvement slows down considerably after a certain point. I don’t think these flywheels will continue to generate material improvements for Upstart or their platform for banks.

They seem to have better models but I don’t think these flywheels lead to a strong moat long-term.

What is the funding model?

Upstart is packaging its improved credit risk model with a cloud lending solution for banks. They share that 22% of the loans in Q3 2020 were retained by banks but haven’t shared numbers for the previous years. The percentage of loans originated through white-labeled banks platform is presumably increasing and I think the long-term goal is to sell all the loans to banks and only operate the platform. This will help them pitch as a B2B SaaS provider and enjoy higher multiples compared to online lending companies. They fund the rest of the loans via the private markets i.e. securitizations.

What is the revenue model?

Upstart earns revenue through fees and divides into 3 types:

Platform fee - $400-$500 per origination - paid by the bank partner

Referral fee - $200-$300 per origination - paid by the bank partner

Servicing fee - 0.5%-1% of outstanding loan volume - paid by the bank partner or institutional investor

Platform fee:

Upstart has carefully not used the word origination fee for their revenue sources. Even though they charge a 5%-8% origination fee from consumers at the time of origination. I think they are restating the origination fee as “Platform fee” and claiming it’s paid by the bank partner. It’s paid by the borrower - may be to the bank and the bank transfers it to Upstart but it is still an origination fee. Interestingly, they added it as a dollar amount and not as a percentage of origination amount. I think I know why.

If you state an origination fee as a percentage, it is dependent on the origination amount. So, it’s variable. And increasing the average origination amount allows you to collect more fees. It will be clear that Upstart is just increasing the average loan amount to pump up their origination fee numbers.

* I suspect Upstart’s marketing fee as a % of revenue is lower because they have increased the average loan amount.

Referral fee:

The referral fee is earned from the bank partner that originates a loan using the Upstart platform. I suspect it is a combination of a monthly minimum SaaS fee plus a referral fee for each origination. Again, I think it’s a percentage of the origination amount. In Q3 2020, only 22% of the loans were originated by banks using the platform. I expect this percentage to go up in the future.

Servicing fee:

It is a fairly standard 0.5%-1% fee earned by companies servicing the loans.

All fees account for 96% of their revenue.

What does credit performance look like?

I read their latest securitization report to understand their origination patterns. Some highlights:

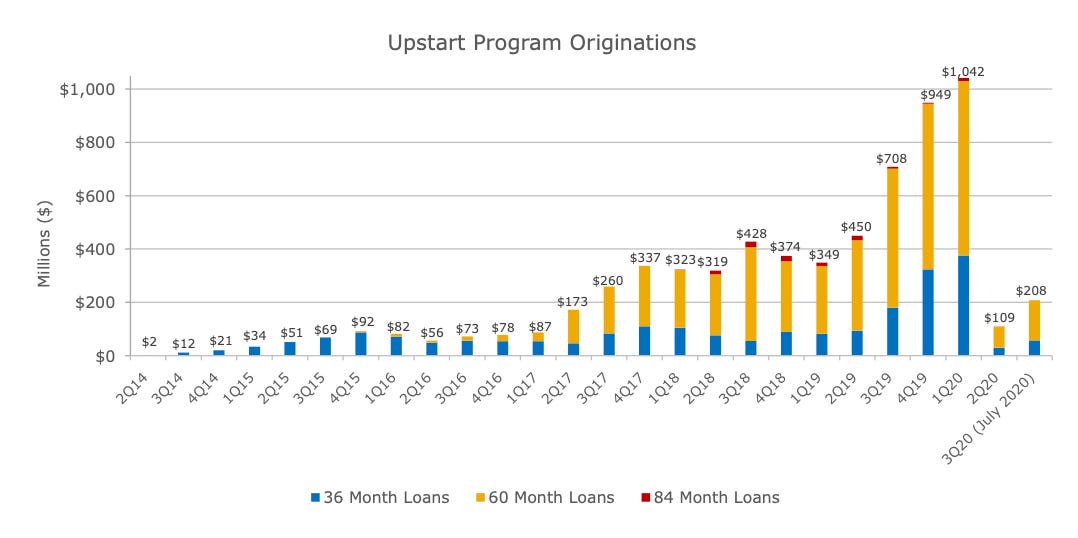

1. Upstart is originating more longer-term loans:

The ratio of 60-month loans as a percentage of the overall portfolio has consistently increased. It has increased at a faster pace in the last 4-6 quarters

The average loan size for a 36-month loan is $9,873 and for a 60-month loan is $18,914

As Upstart originates longer-term loans, they earn a higher origination fee

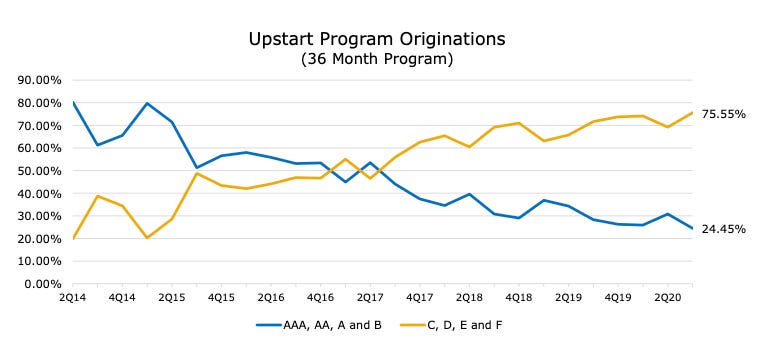

2. Upstart is originating riskier loans to earn a higher origination fee (platform fee)

Upstart is consistently increasing the ratio of high-risk loans in their portfolio - now 75% of the loans originated are C, D, E, F grades (these are the high-risk grade loans)

This is true for both 36-month and 60-month loans

3. The loan performance has degraded in the last few quarters

Cumulative Net Losses have increased from average 10% after 36 months to 12%+ after 36 months

As the average loan term has increased, the losses will increase for a longer period before going flat

This doesn’t give me confidence in Upstart’s revenue sources. They are pushing the envelope in terms of risk and originating riskier loans. My concern is that Upstart will increase allocation to even riskier 84-month and 120-month loans.

Info that I would love to have.

I couldn’t find a few data points either in the S-1 filing or their securitization:

Average loan size by month (for all loan terms)

Average origination fee (platform fee) charged by month (for all loan terms)

On non-loan related numbers, we are missing a few key data points:

Profile of banks using Upstart’s platform - the ideal target bank is not clear from Upstart’s S-1. There are a lot of banks in the U.S. but most of them may develop (or have already developed) their own lending solutions

The adoption rate of Upstart’s platform by banks - we don’t know how Upstart grows with a bank after they start using Upstart’s platform. It is important to know that once banks adopt Upstart’s platform, they use it for more originations over time

But if the loans continue to perform and banks are willing to take higher risk, it will be beneficial for Upstart’s revenue. They will be able to lower their own risk and originate more loans for the banks.

What about growth, IPO positioning is all about growth, is the company growing and does it have levers to continue growing?

Upstart has been on a rapid growth trajectory. They increased revenue from $51M in 2017 to $159M in 2019. That’s 3x+ in 2 years. And they are on pace for another 50% growth in 2020 despite COVID. These are great growth numbers. But let’s look at what is the potential for the next 5-10 years.

Upstart correctly pointed out that their models can be used in other areas of lending such as auto loans, credit cards, and mortgages. These are big markets - $625B in auto loans, $363B in credit cards, and $2.5T in mortgages are originated every year in the US. There’s the cherry on top - student loans, point-of-sales loans, and Home Equity Lines of Credit, or HELOCs. Not all of these products and originations are addressable by Upstart but there’s a lot of room for growth.

If banks like using Upstart’s platform, they can tweak the models to originate multiple products. Credit cards and auto loans are low hanging fruits for Upstart’s approach. The borrower profile is fairly similar for personal loans and the dollar risk isn’t too high. Banks should be willing to test these models on multiple products resulting in a higher revenue per customer for the bank, and a deeper relationship with Upstart for the bank.

That’s why it is so important to understand the target bank profile and what percentage of the overall book is a bank originating through Upstart and how it changes over time. If a bank is seeing positive results, they should move all of their originations through Upstart (or as much as they can).

Competitors

Upstart also has competitors who are trying to capture a bank’s technology spend in different ways.

Blend Labs is a $1B+ technology provider to large U.S. banks for mortgages. It has also recently started offering credit cards, auto loans, personal loans, and deposit accounts.

Amount (spun out from Avant) has also partnered with mid-tier banks to help them originate personal loans digitally.

Prosper is also selling its cloud lending solutions to banks.

Ncino offers an integrated no-code solution for banks to manage almost everything including loans.

These are examples of a few startups that are also going after the same market as Upstart. But none of them offer a new Artificial Intelligence-based lending platform. There are hundreds of other technology companies that want to offer cloud lending solutions. Upstart can use this as a differentiator to sign up banks faster than other players.

How does Upstart compare with LendingClub?

LendingClub and Upstart are both in the consumer loan via the internet business. Comparing the two a few items stand out.

Upstart is going public ($164M in 2019) with a lot more top-line revenue than what Lendingclub went public with ($98M in 2013). However, LC had a small profit of $7M at IPO. Upstart hopes to end 2020 in the black, with a similar amount. In 2019 they had a loss of $5M. However, LC's topline is still 4X larger than Upstart. Upstart has a long way to go to reach LC's size.

LendingClub is extremely efficient at marketing compared to Upstart. From 2017 through 2019, LendingClub spent an average of ~260M/year in marketing (38.5% of revenue) vs Upstart spending $63.5M/year in marketing (~60% of revenue). Upstart spends twice the amount to get the same dollar of revenue as LendingClub. You can make the argument that Lendingclub is a mature company and it's unfair to look at current marketing efficiency. However even in 2013 when LendingClub IPO'ed, it only spent 40% of revenue on marketing. Upstart has a long way to go in this metric.

LendingClub outspends Upstart massively on the product and tech front. On an absolute basis, LC's $168M 2019 tech spend dwarfs Upstart's spend at $18.7M. Upstart makes a lot of assertions that their funnel is highly automated and the secret sauce is the AI model and infrastructure. However, I am surprised that their ops spend is more than their product and tech spend. In 2019 Upstart spent ~25M on ops vs $18M in tech. In prior years ops spend was double the tech spend. Pretty strange for a tech company.

Finally in the cash-flow generation capability, upstart has the upper hand. It generated cash in 2018 and 2017. In 2020 it is on track to generate cash ($30.5M generated by Sep 2020). LendingClub has consistently depleted cash from its balance sheet in the last three years.

In summary, my view is that upstart will have a hard time differentiating itself from LendingClub from a pure financial metrics perspective. It's smaller than Lendingclub, less efficient on marketing than LendingClub, and is against a competitor that has a huge balance sheet.

What is the valuation at IPO?

Unfortunately, I believe that Upstart is going to follow the same fate as Lendingclub. Lendingclub wants to be valued as a tech business, but the market is valuing it as a lending finance business. This has been the case with all the online lending companies that were founded in the boom times of the post GFC. LC is valued today at .7X of 2019 sales ($585M Market cap). Using the same logic, it wouldn't surprise me that Upstart is valued near 1X sales, which puts it at a ~165M IPO valuation.

Over-reliance on Credit Karma

In 2019 and the nine months ended September 30, 2020, 38% and 52%, respectively, of loan originations were derived from traffic from Credit Karma. I was surprised by this number, for a company that is about to go public this is a big dependency on a single source of acquisition traffic. The only other channel at scale is direct mail which was 36%, 28%, 23%, and 12%, in 2017, 2018, 2019, and the nine months of 2020. Can the company grow on only these two channels? and only one of the channels that they directly control (direct mail)?

Would we buy at the open?

Rohit Mittal: At this point, I’d be “cheering from the sidelines” on this stock. The stock has the potential for growth and higher multiples if they can reduce their marketing spend and banks use their platform to originate loans. Upstart can drive value for all parties. Once integrated, it’d be interesting to see Upstart’s pricing power with banks. If I see any indication that they can increase the referral fee per loan and are used for multiple products, I’d start a position.

Rohit Sharma: I’m a tad more skeptical than Rohit. Upstart, unfortunately, has a tough road ahead in the public markets. It is going to be hard for them to get away from the LendingClub/Ondeck/Kabbage (bad) valuation story. It is a great achievement to get a company to this stage, and I applaud the founding team for getting this far. But the public market is extremely fickle. I want to cheer for them and want them to succeed, but I find it hard to justify a position in them vs the benchmark S&P index.