Analyzing Mission Lane's latest $325M securitization filing

Mission Lane is an interesting credit card business that has been on a growth streak. I reviewed Mission Lane's recent securitization filing with takeaways for founders.

It’s been a while since I’ve reviewed a securitization. It’s always good to keep up with the latest in the securitization world because they are a major provider of liquidity for many portfolios.

I’ve been following the growth of Mission Lane’s portfolio for a while and they have done well balancing growth and credit risk.

This time I also added a few tactical takeaways for founders.

In this post, we’ll discuss:

Overall portfolio trends

Mix of credit tiers

Geographic distribution

Loss and delinquency performance

Takeaways for founders

Let's examine the $325 million collateral pool that backs this Series 2023-B deal.

First, some background on Mission Lane.

About Mission Lane

The company began as the credit card division of LendUp in 2015 and was spun off as an independent fintech lender in 2018. It's backed by over $450 million in equity from investors like QED Partners and Oaktree Capital.

Mission Lane maintains lending partnerships with TAB Bank and WebBank to originate general purpose Visa credit cards.

Credit card product:

The program targets near-prime and subprime borrowers with a Vantage score between 550 and 700 and offers credit lines ranging from $300 to $3,000 at APRs between 19.99% and 29.99%.

There is also an annual fee of up to $75.

They use machine learning based risk models and traditional underwriting. The company also monitors and tests the models and deploy a new version approximately every 6 months.

Securitization:

Mission Lane recently issued its Series 2023-B securitization backed by a $325 million collateral pool of credit card receivables.

As of this securitization, Mission Lane had 1.9 million active customers and servicing $1.9 billion in receivables.

Overall Portfolio Trends

Here’s a quick summary of the collateral:

Number of accounts: 2.4M

Total Receivables Outstanding: $1.9B

Avg Receivables Balance: $971

Avg Credit Limit: $1,532

WA Age of Accounts: 24 months

WA FICO: 623

WA APR: 32.88%

Mission Lane has experienced robust growth since inception, with managed receivables ballooning from $250 million in early 2018 to over $1.9 billion currently. However, the bulk of this growth occurred during the COVID-19 pandemic (2020-2021), when government stimulus and lender relief programs supported consumer credit.

Portfolio performance has weakened post-stimulus in 2022-2023, driving higher losses and delinquencies. In response, management has pulled back on riskier lending and tighter credit standards are showing in this newer deal vintage.

In the chart below, we can see the rapid receivables growth through mid-2021, followed by slowing originations in 2022 as credit tightening took hold. Delinquencies have also climbed back toward pre-pandemic levels.

This slower growth period has allowed Seasoning to increase as well, which can improve stability. The current collateral pool has a 24 month average age with an average credit limit of $1,532.

Now let's break down the specific credit tiers underlying this portfolio.

Mix of Credit Tiers

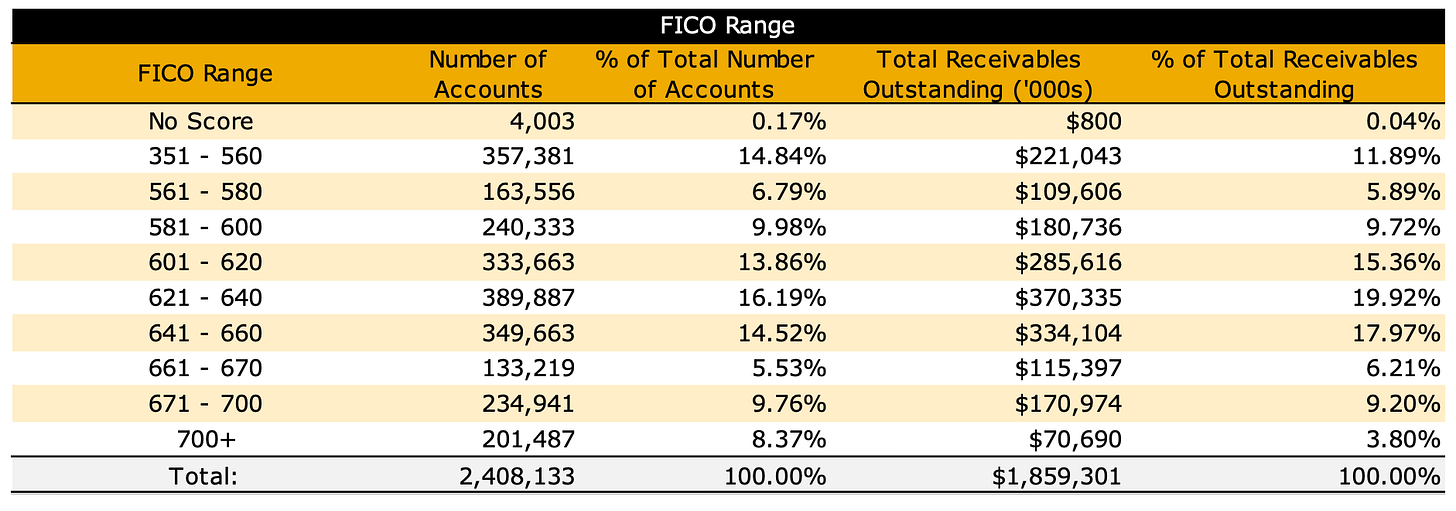

Given its subprime focus, it's not surprising that over 80% of Mission Lane's current accounts have origination FICO scores below 660. This concentration toward deeper subprime obligors is a double-edged sword. While it can generate very high yields, even a moderate downturn in the credit cycle can spur outsized losses.

Digging deeper into the FICO distribution:

0.17% have Missing/No Scores

61.83% are Subprime (FICOs below 640)

29.18% are Near Prime (FICO 641-700)

8.37% are Prime and above (700+)

Based on the receivables

However, compared to earlier 2022 and 2023 deals where 65%+ of loans were Subprime, this Series 2023-B vintage shows a bit less risk concentration following Mission Lane's credit policy changes.

The following FICO mix tables illustrate the lower risk profile:

In addition to tighter FICO distribution, average credit limits have dropped over 20% from $1,900 in mid-2021 to around $1,500 currently. Smaller line sizes help limit loss severity when delinquencies arise.

The majority of the portfolio (91.27%) is at a greater than 30% interest rate.

Geographic Distribution

Regionally, Mission Lane's accounts remain concentrated in coastal states like California, Florida, and Texas. The top 5 states combined comprise 41% of the outstanding balance.

While not ideal, this geographic skew toward large population states isn't uncommon in consumer lending. And the concentration risk appears manageable given the Granular pool of over 2 million accounts.

Here is the state distribution:

Principal Payment Rate

We see a clear correlation between stimulus and the payment rates for this population. As borrowers received checks from the government, we saw a 3x payment compared to the average.

I expect that the payment rate will continue to go down as borrowers run out of savings and the broader economy faces recessionary forces.

95% of the payments are made through ACH and 5% through checks and other methods.

Losses and Delinquencies

Speaking of stability, let's examine Mission Lane's overall delinquency and loss performance history.

While trending higher in 2022, 30+ day delinquencies for the total managed portfolio have remained around 7% - significantly below older vintages. Again, this demonstrates the benefits of tighter underwriting despite some normalization as stimulus programs ended.

Annualized net charge-off rates have also rebounded from unsustainably low pandemic figures. At around 10% currently, losses remain well controlled compared to historical levels approaching 20%.

While reasonable given today's environment, losses could breach 20% in a severe recession based on 2008-2010 data. The securitization structure provides rating level credit enhancement to buffer against potential volatility.

Takeaways for founders:

If you are a founder, aiming for a debt facility and building a model with a target cost of capital, securitizations can help you understand those.

WA Coupon (to investors) for MLANE 2023-B is 9.43%.

Servicing Fees is 3.50%.

Gross Excess Spread is 19.95%.

There are also credit enhancements using excess spread, overcollateralization, subordination, and a reserve account.

Modeling an appropriate cost of capital given the current market helps you project better future cash flows and gives confidence to investors.

The effective cost of capital is generally higher than the stated coupon due to credit enhancements.

Cash may be stuck for a while until subordinate and reserve capital is returned, so plan for your expenses accordingly. You don’t want to be stuck in a high asset but no cash flow situation.

The excess spread of your portfolio should be commensurate with the default volatility.

All securitizations are a window into the stable state cost of capital if your business relies on borrowing. Being aware of that can help you build a better business.

Hi Rohit. I have been founding member of Bangladesh's biggest startup ShopUp. I've recently moved to Canada and I'm seeing a gap in the immigrant student loan market due to lack of credit scores. I see you built a very similar company in the states. What are your thoughts on the potential Canadian market? Any reason you didn’t expand to Canada?