Analyzing $200M securitization from Brex

Brex announced their $200M securitization a few months ago. I look into their business model, growth, and the unit economics of corporate credit cards.

Brex is the only major corporate card issuing startup who have securitized portfolios.

Brex recently announced a $200M securitization (Brex Commercial Charge Card Master Trust Series 2024-1) backed by corporate charge card receivables.

This is the 4th securitization by the 7 year old company and provides interesting insights into their business.

Brex Overview:

Brex is a fintech startup that offers corporate charge cards for startups and enterprises.

Since it was founded in 2017 with corporate credit cards, Brex has expanded to cash management accounts, and expense management tools.

Brex has raised $1.24B+ in equity and at least $800M+ in debt.

As of Q3 2023, Brex had approximately $647 million in total equity.

Brex has amassed 20,000+ clients from small startups to large enterprises like Doordash, Warby Parker, Robinhood, Hims, etc. with an outstanding receivable balance of approximately $513 million.

Brex has completed $40B+ in overall card transaction volume since launch.

Brex has 1,000+ employees and has not been profitable.

*Stilt was a Brex customer.

Brex Debt Facilities:

Brex has three asset-based lending facilities backed by their charge card accounts.

These facilities have total committed capacity of $815 million and an uncommitted capacity of $130 million.

As of January 31, 2024, the total outstanding on these facilities was $267 million.

Product:

Brex started by offering corporate charge cards for startups (non-revolving) and has evolved into offering a suite of financial products.

Current products offered by Brex:

Corporate Charge Card: A non-revolving charge card that requires full payment of the balance at the end of each monthly statement period.

Financial Software: Brex offers financial products and services, including spend management tools and software that integrates with customers' accounting systems.

Features of Brex products:

High Credit Limits: Credit limits are based on a percentage of the business's available cash balance, which allows Brex to offer higher limits to well-funded startups.

No Personal Guarantees: Unlike traditional corporate cards, Brex does not require personal guarantees from business owners.

Rewards Program: Customers can earn rewards based on their purchase volume.

Automated Payments: Brex automatically collects due balances directly from customers' bank accounts using ACH.

Real-time Monitoring: Brex's system allows for real-time transaction monitoring and dynamic credit limit adjustments.

Expense Management: Features include multi-level account permissions, receipt capture, and automatic expense categorization.

Accounting Integration: Seamless integration with popular accounting software for easier reconciliation and financial management.

No Interest Charges: Brex does not charge interest on unpaid balances, as full payment is required each month.

Brex launched a product focused on SMBs but shuttered the product soon after and exited that market. Brex is now only focused on VC-backed startups and large enterprises.

Brex’s target customers have high growth, high cash flows, and are cash rich.

Partner Banks and Networks:

Brex partners with 3 different banks and both networks for their products.

Brex corporate charge card is issued in partnership with Emigrant Bank, Fifth Third Bank, and Airwallex (as applicable) with Mastercard as the card network.

Brex also issues cards with Sutton Bank and Visa network.

Checking accounts are supported by Column Bank, N.A., and Treasury services are offered by a subsidiary Brex Treasury LLC.

Business Model:

Brex earns the bulk of its revenue from interchange fees. They don’t charge any interest on balances or any late fees.

Interchange fees are usually 1%-3% of the spend. Since Brex operates on a commercial credit bin, they earn the highest interchange possible for corporate cards.

The interchange varies by the merchant, category, and a number of other factors.

Customers are expected to pay the outstanding balance in full at the end of every month. Brex doesn’t charge any interest or fees on the outstanding balance.

Brex has expanded its suite of products and now charges monthly subscription fees for some of them.

Brex offers tons of rewards for startups. A few years ago, they were one of the highest rewards providers. Recently, they have reduced rewards and conversation rates with partners.

Brex is still unprofitable. The rewards

Growth:

Brex has been on a tear since they launched 7 years ago.

Brex covered the Bay Area with billboards soon after their launch. You could not skip seeing Brex billboards wherever you turned.

This resulted in massive growth in the early days, and when Brex launched the enterprise business, it grew even faster.

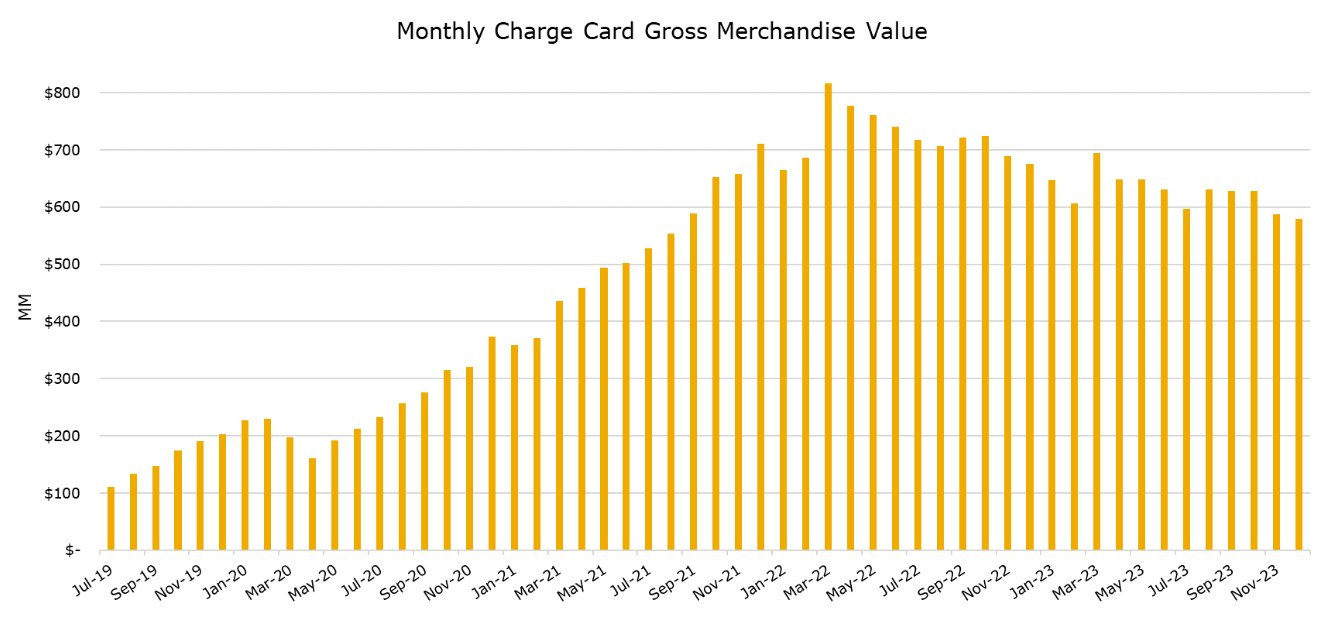

- Brex grew origination volume 8x in 30 months ($100M/month in June 2019 to $800M+ per month by March 2022)

- Peak monthly origination volume of $800M+ per month in March 2022 (~$10B annualized)

- As of Dec 2023, monthly origination volume has dropped to $579M per month (~$7B annualized)

Brex’s Underwriting:

Brex built the product in a way that wouldn’t require startup founders to give personal guarantees. They were the first to use the cash balance in the company’s account as the sole underwriting variable.

Brex excels at underwriting, as evidenced by their low default rates. Their underwriting process combines cash balance, linking the company’s primary bank account, real-time monitoring of balances, and high coverage ratios.

Brex manages risk by dynamically changing credit limits, freezing cards, tracking revenue (for large enterprise customers), and conducting manual reviews for approving higher limits.

Below is an overview of their underwriting:

Cash Balance Focus:

The primary factor in Brex's underwriting is the customer's available cash balance.

This approach allows Brex to serve young companies with limited credit history but significant funding.

Bank Account Linking:

Customers are required to link their “primary” corporate bank account to Brex's system.

Brex uses Plaid as their primary provider for connecting to bank accounts.

Real-Time Monitoring:

Brex continuously monitors the linked bank account in near real-time.

This allows for visibility into the company's cash position and burn rate.

Brex Cash Coverage Ratio:

Brex assigns each company a "Brex Cash Coverage" ratio, typically between 1x to 20x+.

This ratio determines the credit limit as a percentage of the cash balance.

For example, a company with a 10x ratio might get a credit limit equal to 10% of its cash balance.

Additional Factors for Larger Clients:

For larger enterprise clients, Brex also considers factors like annual revenue, length of operating history, and repayment track record.

Bank Statement Underwriting:

For customers unable or unwilling to provide a linked bank account, Brex offers manual underwriting based on regular bank statements.

As of the report date, about 13% of accounts were underwritten this way.

**Some customers may receive a minimum floor credit limit regardless of their initial cash balance. This is targeted for early stage startups with low cash balances. e.g. companies that are selected in Y Combinator.

Risk Mitigation Features:

To minimize the risk of loss, Brex takes additional precautions pre and post-origination.

Dynamic Credit Limits:

Credit limits are adjusted periodically, sometimes daily, based on changes in the customer's cash balance.

Limits can be quickly reduced if there's a significant decrease in available cash.

Manual Review for Higher Amounts:

Credit limits over $1 million require additional approval.

As of the report date, 7.30% of accounts had credit limits over $1 million.

Responsiveness:

Integration with VC firms' fund administration software for proactive funding notifications.

Ability to adjust credit limits downward within 24 hours for at-risk accounts.

Fraud Risk

Brex also manages fraud risk using in-house technology and vendors. They employ well-accepted techniques such as transaction monitoring, limiting transactions at fraud merchants, etc.

2024-1 Securitization Metrics:

Since launching, Brex has put top notch performance metrics and extremely high stickiness.

Cash coverage (bank account cash balance) was not a common underwriting criteria for corporate charge cards but Brex has shown a strong performance history.

The pool consists of $326mm of seasoned receivables across 13,249 accounts.

Important to note that securitization is only for a subset of Brex customers. Not all of Brex’s customer balances are reflected in this transaction.

Key metrics:

- Avg balance: $34,974

- Avg cash balance: $4.5M

- Avg active credit limit: $270,122

- Avg cash coverage: 12.9x

- Top industry: Software (18.5%)

- Top state: CA (41%)

- Top 10 obligors: 4.9%

- 87% of the principal balance has 4x+ cash coverage and 38% have 10x cash coverage. So the portfolio is pretty safe.

- 80%+ of the customers have $1M+ cash balance.

- ~70% of the customers have connected their bank accounts

Client Concentration:

Software is their biggest vertical, followed by Healthcare.

If you add all the variations of the word “software”, as an industry, it accounts for ~50% of the overall balance.

Healthcare and related industries are a distant second with 20%-25% of the overall balance. It makes sense given that Brex launched products specifically focused on that segment.

Servicing and Collections

Brex handles all servicing directly. It includes customer communication, deducting payments at the end of every month, generating statements, collecting delinquent accounts, etc.

Brex may use external law firms to assist with collections. e.g. in case of a bankruptcy

Nelnet is the backup servicer.

Repayments:

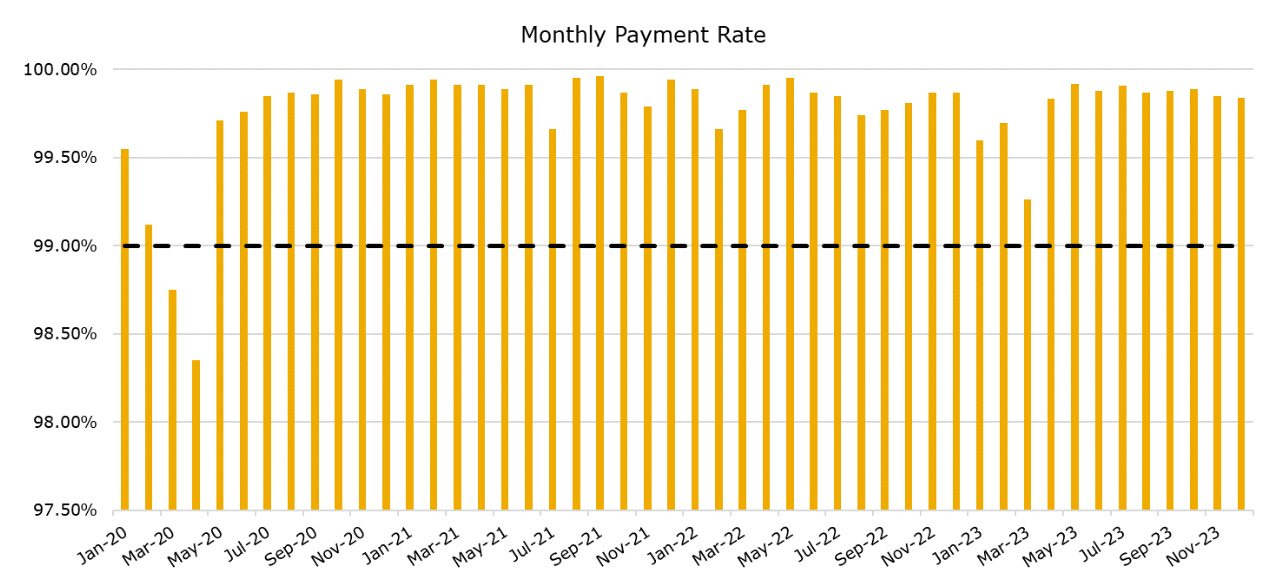

Monthly repayment rates have consistently been greater than 99%, mostly above 99.5%. This dropped to 98.8% during COVID but has come back up since then.

The excess spread on the deal is 47.99% - which is insane.

Delinquencies and Charge-Offs:

30+ day delinquency has stayed minimal at 0.34%. If a company is more than 1 dpd, they have the card privileges revoked until they are current.

An account is charged off when an outstanding balance has exceeded 120 days past due and no payment has been made within the immediately preceding 30 days.

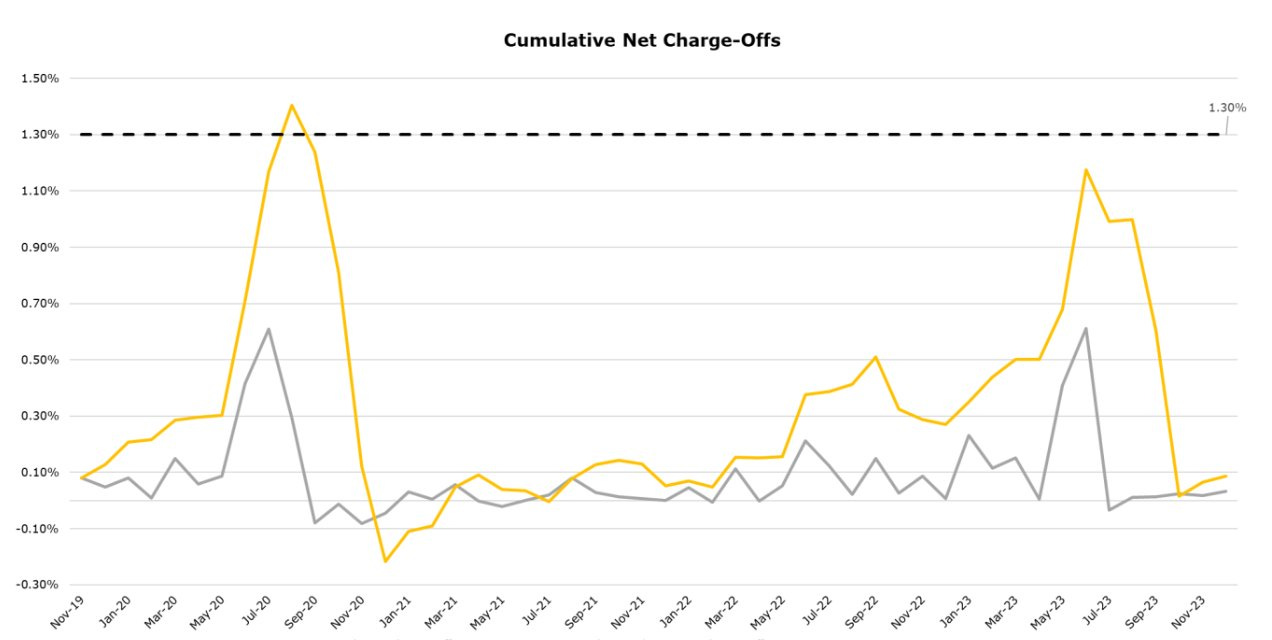

Normalized charge-offs are ~0.20% per month, they spiked during COVID but have come back since then.

Cumulative lifetime losses on the portfolio are just 0.92% since inception.

Credit Enhancements:

The A tranche also has ~25% credit enhancement as a combination of overcollateralization, subordination, and reserve account.

Brex’s core product has been doing well. And they are now right sizing the business and adding more products to move towards profitability.

As I have learned from Brex, they don't securitize the whole business. It's only a part of their overall business. So, this data represents a subset of Brex's products and customers.

I hope this helps give you a fair understanding of securitization and the corporate credit card business.

Feel free to reach out if you’d like to learn more or have any questions.