A framework for evaluating consumer credit startups

How to evaluate B2C companies that offer credit products.

U.S. consumer credit businesses have exploded in the last decade. There are 500+ new startups serving consumers with products at different stages of their lifecycle. These companies are offering products across all categories trying to take away consumers from the big banks. Their innovations have brought consumer credit products to the 21st century and improved access.

Still, these startups haven’t been able to sustain valuations in public and private markets.

The largest IPO in the industry has failed to deliver — Lending Club went public in 2014 and is currently down by 89%.

LC stock price as of Aug 20, 2019

The innovations are not limited to one product. Almost all credit products offered by the banks have been disrupted by technology and startups. A few categories:

Unsecured personal loans — for prime and subprime customers

Mortgages — better processes, lower rates, and lower down-payments

Point of Sale — buy a product with a loan instead of using credit cards

Payday loans — instant loans of up to $500 at 300% APR

Credit Cards — for people with no FICO (or use-case based virtual cards)

There are many other products and verticals such as student loans, auto loans, lines of credit, title loans, loans against retirement accounts, and HELOCs.

The unsecured personal loan industry originated $138 billion in loans in 2018. The primary driver of this big surge are startups — they originated ~40% of the loans (up from 5% just a few years ago). The growth is real and so is the competition. As more startups compete in the same verticals, their margins are lowered (even for the big companies). None of them have been able to capture enough value from the growth of the industry.

The main reason for poor performance is the lack of long-term competitive advantages for these companies.

Most of these hundreds of consumer credit companies started in the last 10 years are either dead or still not big.

A few breakout companies from the early years — SoFi, Lending Club, Elevate Credit have not delivered on investor expectations in the public and private markets. They are still fragile and have not been able to dominate a large portion of their target markets.

It’s because of 3 reasons:

- no durable advantage in acquiring customers at scale

- no moat in underwriting using unique data (or no proprietary data)

- no cost of capital advantage (compared to banks/other players)

It is important for us, at Stilt, to determine our long-term differentiating factors. I have been thinking a lot about what separates sustainable and profitable consumer credit companies from the ones that are bleeding cash and going nowhere. I looked at many startups and large players to figure out the key dimensions of differentiation and defensibility.

The only 2 areas of defensibility are: unique acquisition and underwriting. In terms of importance: acquisition — 75% and underwriting — 20% (everything else is 5%).

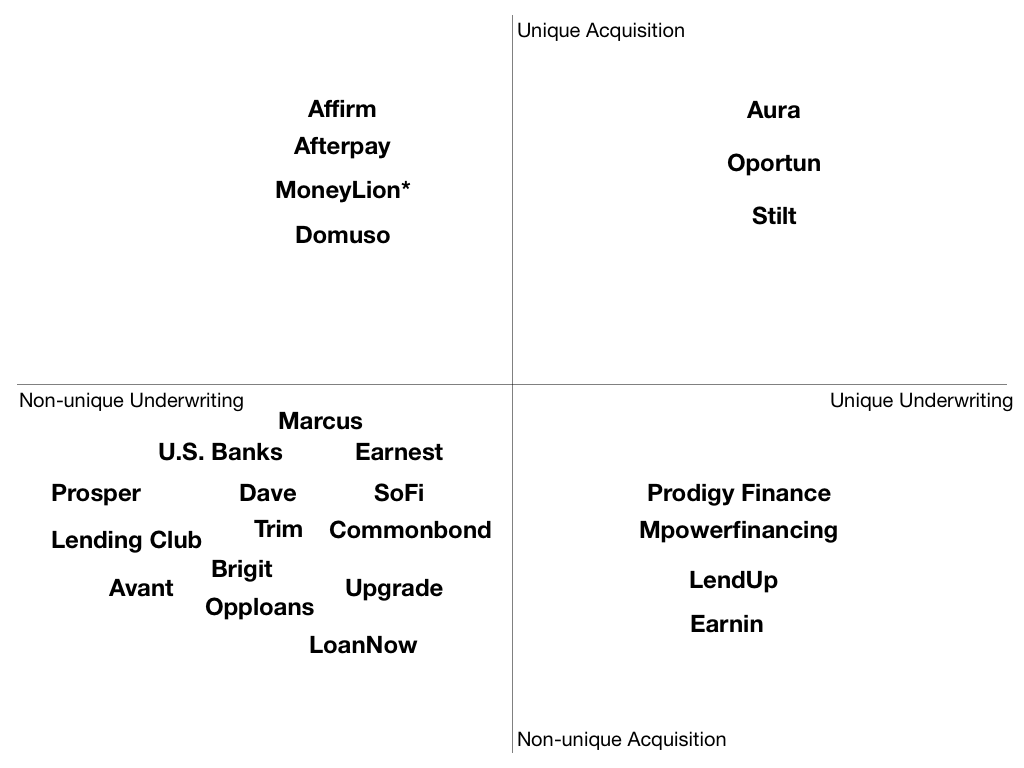

Here’s how I view the current landscape on these dimensions as of today:

* There may be disagreement on where companies fall in those quadrants

* Not taking into account the potential market size for a startup

U.S. consumer lending startups based on strength of acquisition and underwriting

Let’s look at both the dimensions briefly:

Unique Acquisition

This is a company’s ability to acquire customers at scale without significantly increasing costs. This is tough for most companies. As consumer credit companies scale, they start to compete in channels dominated by banks and established players — e.g. Direct Mail. Top 10 nonbank lenders sent 368 million offers in May 2018 alone. That’s 4.4 billion pieces of mail in 2018 (from just the top 10 non-bank lending companies). Add banks and other lenders to the mix and the direct mail volumes get crazy high. There’s too much competition. It works well for large players (because of brand recognition and expertise) but startups get creamed if they try this channel early in the lifecycle of the company.

So, startups can’t really compete on these standard channels. They need to deeply think about a unique way to acquire customers that others can’t immediately copy. This is not a sexy way to think about a tech startup but it is the key to building a successful credit business. The market is filled with companies that have no insight into acquiring customers through non-standard channels. Their best bet is to spend a ton on marketing and grow their books hoping that a differentiated brand will help them. This almost always fails to generate any long-term value.

What does acquisition advantage look like?

A unique acquisition strategy helps a company acquire customers without adversely selecting for risk. For example, Affirm does a great job of acquiring customers using merchant partnerships as their primary acquisition channel. Once a merchant integrates Affirm, they don’t, normally, add other lenders. Affirm locks-in acquisition from that merchant. There is some adverse selection (as consumers who don’t have good credit will try to get a loan) but it works out for Affirm because of higher interest rates and commissions paid by merchants.

Consider 3 things before selecting your acquisition channel — market penetration (of that channel), no adverse selection, and scalability. There are very few channels where all of them will be true.

Unique Underwriting

Underwriting is less important than acquisition and easier to copy. The most important thing to remember is that unique data leads to unique underwriting and not a better machine learning algorithm. If you are collecting the same data as everyone else, a better machine learning model is not a long-term moat.

Unique data leads to sustainable and differentiated underwriting. Not better machine learning models.

To build a long-term moat you have to use new data sources that provide an additional signal in risk assessment. In most cases, the importance of underwriting will depend on how mispriced you think your market is. If you are going after consumers with established credit histories, it’s difficult to significantly improve on underwriting (e.g. SoFi) but if you are going for people without credit histories, you can do something about it (e.g. LendUp).

When it comes to the underserved segments, ideally the new data points are easy to collect, ECOA compliant, have predictive power, and are not a part of the credit report.

The importance of underwriting depends on how mispriced the market is.

The important nuance is that underwriting data collected is dependent on the product and the acquisition channel. e.g. Point of Sale companies can’t expect consumers to fill out long forms and wait for more than 30 seconds for a decision. This limits what information they can collect. It is, generally, a small-dollar loan (avg $750) and a decision needs to be made in seconds (or milliseconds). The loan offers are based on very little information which puts limits on underwriting accuracy.

If your market is thin-file (or their data is not on the credit bureaus) and underwriting relies on unique data, you will need to find channels to collect that unique data. For example, it will be difficult to reach customers through direct mail and collect unique data points (there’s a whole another level of problem in targeting consumers with non-unique data using direct mail).

A couple of additional issues with using direct mail for thin-file customers:

Direct mail offers are based on the data in credit reports and you can’t underwrite differently using the same data as everyone else.

As loan offers are pre-decided before sending the mail, consumers are less likely to fill in new data online when redeeming those loan offers.

All credit marketplaces such as Credit Karma, Nerdwallet, and Lending Tree use the same credit report data to qualify leads. If your algorithm uses alternative data for improved underwriting, you will not be able to filter the right leads from credit marketplaces and this leads to adverse selection.

I see a similar trend for real estate startups that are improving the home buying process with technology and better underwriting. A few recent ones include FlyHomes, Unison, Point, Figure, and DivvyHomes. All of them are trying to offer mostly similar products and currently in land-grab mode. I am confident that they will modernize the industry for consumers but it will be interesting to see how much value can they capture in the long-term.

Bottomline:

If you can get acquisition right and stay true to your underwriting, you can build a large and profitable consumer credit company.

— — — — Notes — — — —

There are some products that are doing well because of their product retention (e.g. Tally) but haven’t shown any unique underwriting or acquisition.

I have not talked about insurance startups even though they can be considered consumer credit businesses.

For very few companies (e.g. Opendoor), competitive channels worked initially because their product was underwriting the asset and not the consumer.